Prologue

- General studies Mains Paper 3: Land reforms in India.

- But that is not ‘the end’ of land reform. Same topic and points also relevant for

| GS Mains paper |

land reform topic indirectly associated with |

| 1 |

- Freedom Struggle – its various stages and important contributors /contributions

- Social empowerment

- poverty and developmental issues

- Post-independence consolidation

|

| 2 |

- Ministries and Departments of the Government;

- Pressure groups and formal/informal associations and their role in the Polity.

- Functions and responsibilities of the Union and the States,

- Indian Constitution: significant provisions

- The role of NGOs in Development processes.

- Issues relating to poverty and hunger

- e-governance

|

| 3 |

- Linkages between development and spread of extremism

|

Besides, Land reform topic is also part of many optional subjects in UPSC Mains:

| Optional Subject |

land reforms included in: |

| Political Science Paper 1 |

Planning and Economic Development : Green Revolution, land reforms and agrarian relations |

| Sociology Paper 2 |

Agrarian social structure – evolution of land tenure system, land reforms. |

| Geography Paper 2 |

land tenure and land reforms; |

| Economics Paper 2 |

Agriculture: Land Reforms and land tenure system, Green Revolution and capital formation in agriculture. |

| History Paper 2 |

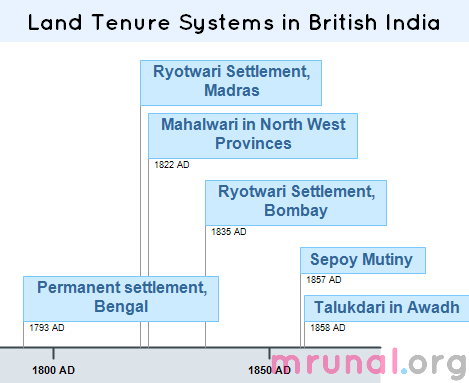

- Land revenue settlements in British India: The Permanent Settlement; Ryotwari Settlement; Mahalwari Settlement;

- Economic impact of the revenue arrangements;

- Rise of landless agrarian labourers; Impoverishment of the rural society.

- Land reforms

|

This [Land Reforms] Article series will (try to) cover following issues:

- Three land tenure system of the British: Their features, implications

- Peasant struggles in British Raj: causes and consequences

- Land reforms, Before independence: by Congress governments in Provinces, their benefits and limitations

- Land reforms, After independence: abolition of Zamindari, Land Ceiling and Tenancy reforms. Their benefits and limitations

- Land reforms by non-governmental action: Bhoodan, Gramdan, NGOs etc. their benefits and limitations

- Land reforms in recent times: Computerization of land records,

Forest rights Act, land reform policy etc. their benefits and

limitations.

Sources used for this [Land reform] Article series

- IGNOU MA (Rural Development) Course code MRDE 003

- Bipin Chandra: India’s struggle for independence

- Bipin Chandra: Freedom Struggle, NBT

- Bipin Chandra: Indian since independence

- Sumit Sarkar: Modern India (1885, 1947)

- Rajiv Ahir, Brief History of Modern India, Spectrum

- Ramchandra Guha: India After Gandhi

- pib.nic.in, Indianexpress, TheHindu, PRSIndia etc. as and where necessary

What is land reform?

- Robin Hood took money from rich and redistributed among the poor.

- Similarly land reform involves taking away land from rich and redistributing among landless.

- Although land reform involves not just about ‘redistribution of land’. It involves many other reforms, example:

| Static (50s to 80s) |

- Abolish intermediaries, Zamindar, Jagirdar etc.

- land ceilings- redistribute surplus land

- Tenancy reforms

|

| current (after 80s) |

- computerize land records

- forest rights act

- land consolidation

|

Formal definitions

| definition |

Land reforms mean: |

| #1 |

Improving land tenure and institutions related to agriculture. |

| #2 |

- redistribution of property rights

- For the benefit of the landless poor.

|

| #3 |

- integrated program

- to remove the barriers for economic and social development

- Caused by deficiencies in the existing land tenure system.

|

Observe that word “tenure/Tenancy” keeps reappearing. So what does that mean?

Tenancy:

- Tenancy in derived from the word ‘tenure’ = ‘to hold’.

- Tenancy= Agreement under “tenant” holds the land/building of the original owner.

Players in Land Tenancy system?

The State

|

- enforces tenancy contracts

- Maintains law and order.

Earns revenue for doing 1+2 |

Owner

|

- The owner: the guy who owns land

- They pay Revenue to the State.

- Rich farmers, Zamindars etc. own hundreds of acres of land. Can’t cultivate it on their own.

- Similarly minors, disabled, widows, soldiers, fishermen may also own land but they can’t cultivate for one reason or another.

- So these people ‘lease’ their land to other farmers (tenants).

|

Superior tenants

|

- They cultivate on land leased from the ^owner.

- These are hereditary tenants. Meaning they cultivate same land generation after generation.

- They pay rent to the owner.

- They have almost the same rights as the owners.

- They can sell, mortgage or rent out the land.

- They cannot be evicted against their will.

|

Inferior Tenants

|

- Other names: tenants at will, subordinate tenants, temporary tenants, subtenants.

- They till the land leased from other tenants/owners.

- They pay rent to the owners/superior tenants.

- They have limited rights over the land.

- They cannot sell or mortgage the land.

- They can be evicted easily.

|

Share croppers

|

- Sharecroppers= cultivate other person’s land (Owner, Superior/inferior tenant)

- They get share from the produce, and remaining goes to the tenant/owner.

- The equipment and inputs items may be provided owner/tenant

- They have no rights whatsoever on the land.

- They cannot sell, rent or mortgage the land.

- Can be evicted easily.

|

Landless laborers

|

- They get paid in cash or kind by the owners (or tenants)

- Sometimes work under begari/bonded labour.

|

Ok well and good. So far we know: what is land reform and who are the

players in a land tenancy system. We have to study land ‘reform’.

Meaning some badass thuggary was going on, otherwise if everything was

well and good, then there was no need for ‘reforms’! So what was the

cause of thuggary/grievance/resentment? Ans. Land tenure systems of

British.

Land Tenure System: British Legacy

In the initial years, East India company faced following problems:

- Demand for British goods in India=negligible. (Because East India company was yet to destroy our handicraft and artisans)

- Under the Mercantilism policy of British: one country’s gain

required another country/colony’s loss. Therefore, British Government

prohibited East India company from exporting gold and silver from

England to pay for Indian goods import.

- Company needed truckload of ca$H to maintain an army for defeating and subjugating native rulers.

East India company came up with following solution:

- start collecting revenue from Indians

- Use that Revenue to buy Indian raw material- export to England

- Import finished goods back to India=> make profit.

But this solution had a problem: the revenue system under Mughals and

Native rulers=too complex for the British to understand, and there were

no coaching classes or Wikipedia to help white men understand this

complex system.

Lord Cornwallis comes with a novel idea: just ‘outsource’ the tax

collection work to desi-middlemen: Zamindars, Jagirdar, Inamdars,

Lambardar etc. Consequently, British introduced three land tenure

systems in India:

| Tenure system |

Presidency |

Features: |

| Permanent settlement |

- Bengal

- Bihar

(BeBi) |

- Who? Cornwallis + John Shore. In Bengal + Bihar. 1793

- Company ‘outsourced’ the revenue collection work to Zamindars

- Very exploitative. Led to many revolts. Hence British didn’t implement it in other parts of India.

- In Awadh/Oudh, Lord Delhousie wanted to implement Mahalwari but then 1857’s munity broke out. Later Lord Canning introduced Talukdari system-similar to Permanent settlement.

|

| Ryotwari |

- Madras,

- Bombay

- Assam

(MBA) |

- Who? Thomas Munro and Read in Madras. (1820)

- Who? Wingate and Goldsmid in Bombay (1835). In 1820

it was tried in Poona but failed. Later Wingate and Goldsmid start

Bombay Survey System in 1835 for individual settlement system.

- Company directly collected revenue from farmers.

- Madras was initially under Permanent settlement type system but

Thomas Munro convinced the directors of East India company to convert

this area under Ryotwari / direct settlement system.

|

| Mahalwari |

- Gangetic valley

- north-west provinces,

- parts of central India

- Punjab

|

- Company ‘outsourced’ revenue collection work to Village community

itself. –Technically village headman (Lambardar) was made responsible

for tax collection

- North West Provinces initially had Permanent settlement but transformed to Mahalwari system by Holt Mackenzie.(1822)

|

Overall coverage

| Tenure system |

% of Agri.land in British Provinces |

| Zamindari |

57 |

| Ryotwari |

38 |

| Mahalwari |

5 |

| Total |

100% |

Permanent Settlement: Features

- Cornwallis + John Shore. In Bengal + Bihar. 1793

- All the land belonged to the state and was thus at their disposal.

- British designated zamindars (local tax collectors) , as owners of

the land in their district. This system was adopted in several forms

such as Zamindari, Jagirdari, Inamdari, etc.

- These zamindars had to collect revenue from farmers and deliver to the British.

- Converted Zamindars into landlords. The right to the land conferred on the zamindars was

- Revenue amount was fixed at the beginning and remained the same permanently.

- Zamindar were given freedom to decide how much to demand from the cultivators. Stiff penalties on defaulters.

- there was a provision of keeping a portion of taxes for the zamindar himself.

- Zamindar’s right over land was

- Alienable: meaning British could take it away and

give it to another Zamindar, if first Zamindar did not meet the Revenue

collection ‘targets’.

- Rentable: meaning Zamindar himself could further outsource his work among more smaller zamindars

- Heritable: meaning Zamindar dies, his son/brother etc would get it.

- Farmers became tenants. Two types

- Tenants-at-will: farmers who cultivated on Zamindar’s land. They had no rights. They could be evicted as per whims and fancies of Zamindar.

- Occupancy Tenants: farmers who owned land. Their

occupancy rights were heritable and transferrable and were not tampered

with as long as they paid their taxes.

Permanent Settlement: Consequences

#for British

- gave financial security for the British administration.

- Cost of running administration decreased. Because British had to

collect Revenue from only a few Zamindars instead of lakhs of farmers.

- British got new political allies (Zamindars). They would keep their

own militia to suppress peasant revolts, and act as ‘informers’ and

remained loyal to British rule.

#learning from mistake

- Permanent settlement system led to many agrarian revolts.

- Government’s income declined over the years, Because Revenue was permanently fixed + number of intermediaries kept increasing.

- Hence, British learned from the mistake and did not extent this

permanent settlement/Zamindari system to the whole of India. Instead,

they established Ryotwari and Mahalwari systems in the remaining parts.

#Farmers lose bargaining power

- Textile industry was the driver of industrial revolution in Britain. = raw cotton imported + finished textile exported to India.

- To prevent any ‘competition’ from Desi textile industries, the

British imposed variety of taxes and tariffs on them=>desi textile

business collapsed. Lakhs of weavers became unemployed, migrated to

villages in search of work.

- Since they did not own any land, they had to become tenants-at-will for Zamindars.

- Now Zamindars had the monopoly of controlling livelihood of thousands of people. They extorted more and more taxes.

- Moreover, the “begar”, unpaid work which the tenants were forced to

perform on the zamindar’s land, took larger proportions. On the average,

it amounted to 20-25 % of the lease.

- Western Bengal: Farmers got divided into two categories i) Jotedars (Rich farmers) ii)Bargadar (Sharecroppers)

- Eastern Bengal: Jute cultivation. Independent farmers with small to middlesize land holdings

#More outsourcing

- Permanent settlement system created landed aristocracy for the first

time in India. Zamindars used to chow down part of the land Revenue

collected. Thus they became wealthy and lazy. They ‘outsourced’ their

work to more intermediaries / sub-tenants.

- It became quite common to have 10 to 20 intermediaries, more or less

without any specific function, between the government and the farmers,

And they all had a share in the cultivation yield + other illegal taxes.

- As a result, 70-80% of farmer’s produce went to just Revenue and commissions only=> poverty, debts.

- None of these middlemen or Zamindars invest money in agricultural

improvement or new technology. They just kept increasing rents. Hence

traditional agriculture did not shift to capitalist agriculture, unlike

other economies.

Ryotwari System

By Sir Thomas Munro at first in Madras State and then adopted in Bombay, and Assam. But Why?

- In permanent settlement areas, land Revenue was fixed. But over the

years, agriculture prices/exports should increase but government’s

income did not increase. (Because middlemen-zamindars chowed it down)

- Zamindars were oppressive- leading to frequent agrarian revolts in the permanent settlement areas.

- In Bihar, Bengal, there existed Zamindar/feudal lords since the

times of Mughal administration. But Madras, Bombay, Assam did not have

Zamindars / feudal lords with large estates. So, hard to ‘outsource’

work, even if British wanted.

- No middlemen in tax collection=> farmer has to pay less

taxes=>increased purchasing power=>will improve demand for

readymade British products in India.

Consequently, all subsequent land tax or revenue settlements made by

the colonial rulers were temporary settlements made directly with the

peasant, or ‘ryot’ (e.g., the ryotwari settlements).

This model was based on English yeomen farmers.

Ryotwari System: Features

- government claimed the property rights to all the land, but allotted

it to the cultivators on the condition that they pay taxes. In other

words, It established a direct relation between the landholder and the

government.

- Farmers could use, sell, mortgage, bequeath, and lease the land as

long as they paid their taxes. In other words Ryotwari system gave a

proprietary rights upon the landholders.

- IF they did not pay taxes, they were evicted

- taxes were only fixed in a temporary settlement for a period of thirty years and then revised.

- government had retained the right to enhance land revenue whenever it wanted

- Provided measures for revenue relief during famines but they were seldom applied in real life situation.

Ryotwari System: Consequences

- Farmers had to pay revenue even during drought and famines, else he would be evicted.

- Replacement of large number of zamindars by one giant zamindar called East India Company.

- Although ryotwari system aimed for direct Revenue settlement between

farmer and the government but over the years, landlordism and tenancy

became widespread. Because textile weavers were unemployed= they started

working as tenant farmers for other rich farmers. In many districts,

more than 2/3 of farmland was leased.

- Since Government insisted on cash revenue, farmers resorted to

growing cash crops instead of food crops. And cash crop needed more

inputs=>more loans and indebtedness.

- After end of American civil war, cotton export declined but

government didn’t reduce the revenue. As a result most farmers defaulted

on loans and land was transferred from farmers to moneylenders.

Mahalwari System

- Location: Gangetic valley, north-west provinces, parts of central India and Punjab. But why?

- In North India and Punjab, joint land rights on the village were

common. So, British decided to utilize this utilize this traditional

structure in a new form known as Mahalwari system.

Mahalwari System: Features

- unit of assessment was the village.

- taxation was imposed on the village community since it had the rights over land.

- The village community had to distribute these tax collection targets among the cultivators

- Each individual farmer contributed his share in the revenue.

- Everyone was thus liable for the others’ arrears.

- Farmers had right to sell or mortgage their property.

- The village community did not necessarily mean entire village population. It was a group of elders, notables of high castes.

- A village inhabitant, called the lambardar, collected the amounts and gave to the British

- British periodically revised tax rates.

Mahalwari system: Consequences

- Since Punjab, Northern India = fertile land. So British wanted to

extract maximum Revenue out of this region. Land Revenue was usually 50%

to 75% of the produce.

- As generations passed- fathers would divide land among sons=>

fragmentation=>farms became smaller and smaller and productivity

declined.

- But still British demanded Revenue in cash. So, farmers had to borrow money to pay taxes in the case of crop failures.

- As a result, more and more farms passed into the hands of

moneylenders. When farmer failed to repay debt, Moneylender would take

away his farm but he has no interest in self-cultivation so he’d leasing

it to another farmer.

- Thus, sub-leasing, indebtedness and landlessness became more and more common in Mahalwari region

Why is it called Modified Zamindari system?

- Because in Mahalwari areas, the Land revenue was fixed for the whole

village and the village headman (Larnbardar) collected it. Meaning

theoretically Village itself was a landlord/zamindar.

- Other names for this system: Joint rent, ‘joint lease’, ‘brotherhood’ tract (mahal) holding and ‘gram wari’ etc.

Result of British Land Tenure system: Perpetual indebtedness, exploitation. When we gained independence, picture was following:

| farmers |

Agro-land of India |

| 7% villagers (richest, Zamindar and other intermediaries) |

Owned 75% of fertile land |

| 48% of villagers (tenants, sub-tenants) |

Owned 25% of fertile land. (=imagine the land fragmentation and size of landholdings) |

| 45% of villagers |

Owned no land. Worked as farm laborers, petty traders, craftsman etc. |

| Total 100% |

Total 100% |

Consequences of British Tenure systems

Land becomes a property

| Before British |

During British rule |

- private ownership of land did not exist

- land belonged to the village community

- Land was never treated as the property of the kings -benevolent or despotic, Hindu, Muslims or Buddhist.

- Land was not treated as individual cultivator’s property either.

|

- Introduced private ownership of land

- This divided village into 1) landlords 2)tenants 3)labourers

- This this material transformation the agrarian society in India

witnessed profound social, economic, political, cultural and

psychological change.

- with generations- land kept dividing among sons=>land fragmentation, diseconomies of scale, lower production.

|

Panchayat lost Prestige

| Before British |

During British rule |

| Land matters and civil disputes were adjudicated by Panchayat within the village. |

- Farmer had to approach British courts for matters related to Revenue, property attachment, debt-mortgage etc.

- Panchayats lost their power and prestige

|

Food insecurity

| Before British |

During British rule |

- farmers usually grew foodcrops- wheat, maize, paddy, jowar, bajra and pulses

|

- Since British demand revenue in CASH, farmers resorted to growing

cash crops: indigo, sugarcane, cotton=> Area under foodcrop

cultivation declined

- Then, Lacks of People would die of starvation during famines.

- Even after independence, and before green revolution- India was not self-sufficient in grain production.

|

- at independence India was faced with an acute food shortage

- near-famine conditions in many areas.

- Between 1946 and 1953 about 14 million tonnes of foodgrains worth Rs

10,000 million had to be imported = this was nearly half of the total

capital investment in the First Five Year Plan (1951–56).

Canals

| Before British |

During British rule |

- Kings constructed ponds, canals and wells to improve agriculture

- irrigation taxes were moderate.

|

- British did construct new canals

- Positive: more area brought under cultivation, particularly in Punjab.

- but most canals caused salinity and swamps=>declined productivity over the years

- Taxes on Irrigation were quite high. Therefore Canal irrigation was

used to grow sugar, cotton and other cash crops, instead of food

crops=>food insecurity, starvation and death during famines.

|

Cash economy & indebted farmers

| Before British |

During British rule |

- Land Revenue was paid in kind.

- Village was a self-sufficient economy with cooperative units.

- e.g. blacksmith would make farm-tools, would get yearly payment in grains/kind.

- Moneylending, mortgaging were negligible.

|

- British obliged the farmers to pay revenue in cash and not in kind.

- The land revenue was increased arbitrarily to finance British wars

and conquests. But The farmers had no right to appeal in the court of

law.

- Farmers had no understanding of cash economy + frequent droughts and famines

- Hence they had to borrow money from unscrupulous grain traders and

money-lenders=> compound interest rate, perpetual indebtedness.

- Eventually, the typical Indian villager was stripped of all savings,

caught in debt trap, mortgaging almost everything-whether personal

jewelry, land and livestock, or tools and equipment.

|

- Collective village life based on common economic interests and resultant cooperative relations

|

- A new village came-where existence was based on competition and struggle among independent individuals.

|

- Farmers shifted from food crop to Cash crops. But cash crops need

more inputs in terms of seeds, fertilizer, and irrigation, hence farmer

had to borrow more.

- This brought moneylenders, Shroff, Mahajan, Baniya, into limelight-

they were in control of village land without any accountability.

- Thus British land revenue system transfered ownership of land from farmer to moneylender.

- towards about the end of the colonial period, The total burden on

the peasant of interest payments on debt and rent on land could be

estimated at a staggering Rs 14,200 million

- According to RBI’ss survey in 1954:

| credit supplier |

gave ___% of farmers’ loan requirements |

| moneylenders |

93% |

| government |

3% |

| cooperative societies |

3% |

| commercial banks |

1% |

Serfdom

Before: slavery/bonded labour/Begari almost non-existent. But During British raj

- Zamindars gave loan to farmers/laborers and demanded free labour in return.

- This practice prevented farmers/laborers to bargaining wages.

- Begari, Bonded labour, or debt bondage became a common feature in large parts of the country.

- Even in ryotwari areas, upper caste controlled the land. Lower caste was reduced to sharecroppers and landless laborers.

Rural Industry destroyed

| Before British |

During and After British rule |

- India was steadily becoming more urbanized,

- Significant portion of the Indian population living in large or small towns.

|

- de-urbanization and de-industrialization of India

- This led to even greater pressures on agriculture since large

categories of highly skilled artisans and non-agricultural workers were

thrown out of work.

- When the British left, India had become a village-based agricultural economy.

- With an enormous population pressure on agriculture and an adverse land–man ratio of about 0.92 acre per capita at independence.

|

- Even in Villages, there was skilled artisans like weavers, potters, carpenters, metal-workers, painters etc.

|

- Trade tariffs and excise duties were set so as to destroy Indian industries, and squeeze domestic trade.

- Bihar and Bengal: severe restrictions were placed on the use of

inland water-ways — causing fishing and inland shipping and

transportation to suffer.

|

Lack of Capitalist Agriculture

In most economies, the evolution is traditional farming=>capitalist farming methods. But in India, it did not happen, why?

- Large landowners in zamindari and ryotwari areas leased out their lands in small pieces to tenants.

- Small tenants continued to cultivate them with traditional techniques= low productivity.

- Rich farmers/ zamindars lacked the riskbearing mindset for

capitalist mode of production (i.e. invest more money in seeds,

fertilizer, animal husbandry, contract farming, large-scale capitalist

agriculture using hired wage labour under their direct supervision.

etc).

- Even if they wanted to take ‘risk’, government did not give any

agricultural support, credit, insurance etc. yet demanded high taxes.

- It is not surprising, therefore, that Indian agriculture, which was

facing long-term stagnation, began to show clear signs of decline during

the last decades of colonialism.

| farming technology in 1951 |

% of farmers |

| wooden ploughs |

97% |

| iron plough |

3% |

| Use of improved seeds, artificial fertilizers, etc |

rare |

some more points

| Drain of Wealth |

Independent Farmer / tenant was hardly left with any money to

re-investment in agriculture. Most of his ‘surplus’ income/profit went

into paying taxes. These taxes were used for exporting raw material from

India to Britain. = Drain of wealth. |

| Social Banditry |

when individuals or small group of farmers couldnot organize a

collective action against Zamindars/government, they started robbery and

dacoity. |

When India got independence, the situation was:

| VILLAGERS ASSOCIATED WITH FARMING |

AGRO-LAND |

| 7% villagers (richest, Zamindar and other intermediaries) |

Owned 75% of fertile land |

| 48% of villagers (tenants, sub-tenants) |

Owned 25% of fertile land. (=imagine the land fragmentation) |

| 45% of villagers |

Owned no land. Worked as farm laborers. |

| Total 100% |

Total 100% |

Mock Questions

5 marks

- Important features of Munro settlement.

- Mahalwari Settlement.

- Superior and Inferior Tenants

12 marks: comment on following statements

- British land tenure systems were moulded by greed and desire to encourage certain type of agricultural exports.

- Absentee landlordism was a consequence of Bengal’s permanent settlement. Comment

- Though the permanent settlement had serious defects, it gave tranquility to the countryside and stability to the government.

- Permanent settlement disappointed many expectations and introduced many results that were not anticipated.

15 marks

- What the impact was of early British land tenure policy on the villages of North and Western India?

- Examiner the major factors shaping British Land revenue policy in India. How did affect Indian society?

- Describe the impact of British Policy on agrarian society.

- What were the consequences of British rule on Indian villages?

- What were the three kinds of land settlement during British rule in India? Briefly discuss their features and implications.

- What do you understand by Commercialization of agriculture? Discuss its impact on rural India.