How should one read the latest GDP numbers, the first for the new fiscal year 2016-17? The answer is that they are genuinely encouraging for a reason nearly all the commentary has missed: For the first time in seven quarters, nominal growth is back to double digits. And this is an important signal that the economy is truly on the upswing.

In a way, it’s not surprising that this point has been missed, for nominal output is typically of little consequence. After all, it can increase simply because prices are rising. In contrast, real output conceptually measures the total quantity of goods and services produced, making it normally the one true measure of the economy’s health. But these are not normal times, for important reasons.

The first is that the WPI and the CPI have diverged widely, as commodity (especially oil) prices have fallen, complicating the task of calculating real output. Essentially, statisticians build the GDP figures by first taking supply-side data from corporate accounts, which are of course measured at prevailing (current) prices. Their task — or rather challenge — is then to decompose these values into their quantity and price components.This procedure, involving the calculation of price deflators, allows estimation of real magnitudes (the quantities), such as Gross Value Added (GVA), at constant prices. This procedure is always difficult, depending as it does on a number of theoretical and data assumptions and limitations. But the task has been especially difficult these last two years because the two key price indices have been pointing in very different directions.

As an aside, some analysts have attributed the GDP uncertainties to changes in methodology instituted by the CSO in 2014 with the insinuation that the new government was responsible for them. This is off the mark. In fact, the uncertainties would have arisen even under the earlier methodology. Large relative price changes are difficult for any aggregation system to handle.

Given these uncertainties, it is helpful to look at the nominal magnitudes as an indicator of how the economy is doing. Indeed, one could argue that right now — when there have been large relative price shifts — they are more helpful than the real GDP data. The great economist John Maynard Keynes said of the twin Bretton Woods Institutions that the Bank (World Bank) is a fund and the Fund (the IMF) is a bank. In a similar vein, one might say in relation to GDP estimates that the nominal magnitudes are “real” because they are what is actually measured. Meanwhile the real magnitudes are, well, perhaps not entirely “nominal” but certainly something more difficult to interpret.

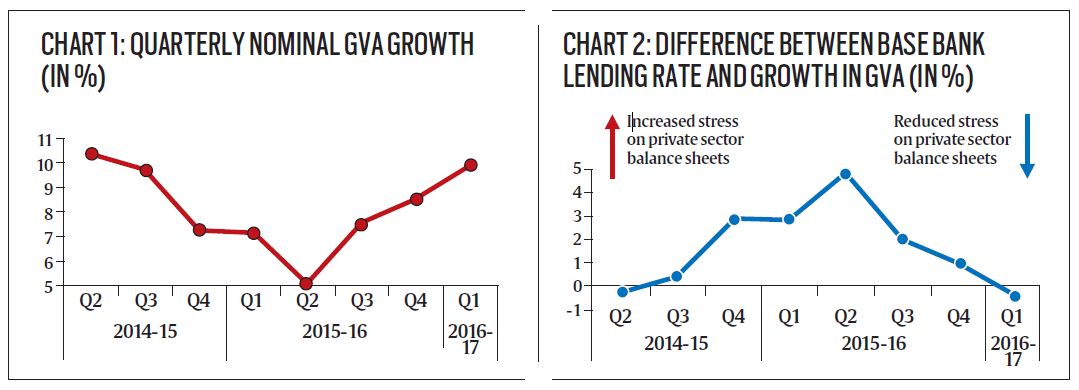

Coming back to the first quarter number for FY2017. Nearly all the commentary has focused on the decline in constant price GDP and GVA growth. But the real story lies in the nominal magnitudes. Chart 1 plots the nominal growth in GVA for the last eight quarters. From the lowest point in Q2 FY2016 of five per cent, nominal GVA growth in the latest quarter has climbed to 10 per cent (9.9 per cent to be precise), a near doubling, and the improvement has been steady. Even relative to the last quarter there has been a sharp increase in nominal GVA growth. (The nominal GDP growth estimate portrays a similar trend but the GDP numbers are affected by the large increase in taxes and reductions in subsidies in the last eight or so quarters which renders the understanding of underlying trends more difficult.)

Now, of course, if the nominal increase is entirely due to increases in prices, underlying economic activity has not been affected. But this would imply that GVA inflation has increased by five percentage points over the past year, which seems implausible. It’s much more likely that the numbers are signalling a real improvement in the economy.

Moreover, there is a second reason why higher nominal growth is welcome: Because it will help address the twin balance sheet problem — the debt difficulties in the corporate and banking sectors — that arguably represents the biggest macro-economic challenge facing the economy. As highlighted in last year’s Mid-Year Economic Review, overall private sector debt sustainability is determined by the balance between the nominal interest costs on borrowings and the ability to generate nominal revenues to pay them. These revenues tend to move in line with nominal GVA growth.

Chart 2 updates the analysis from the Mid-Year Review and illustrates the stark improvement. The wedge between nominal lending rates and nominal GVA growth, which had peaked at five per cent, has become negative again (so that revenues are growing faster than interest costs) which will be a relief for the private sector and for the banking system that is holding private sector debt. In turn, this will help credit growth and private investment to recover, which will impart an impetus to — or at the very least, lessen the current drag on — the economy.

If agricultural growth improves as expected with the favourable monsoon, and if the drag from exports of the last two years has bottomed, as the latest numbers suggest, and if construction can perk up as a result of the recent reform measures, one can be cautiously optimistic about rising growth over the next few quarters.

But the latest figures must not lead us to overconfidence. First, one swallow does not a summer make: Healthy nominal GVA growth must continue for the optimism to be warranted. Second, we need more evidence to be confident that rising nominal GVA growth also reflects rising real GVA growth. Third, faster nominal GVA growth still obscures serious sectoral challenges: For example, investment growth is still negative. Finally, faster GVA growth reflects a high boost from government consumption (not investment), which is not sustainable forever. In other words, robust private sector-led growth is still not fully entrenched.

But meanwhile, subject to the caveats noted above, the sharp increase in nominal GVA growth — at a time of relatively stable inflation — is an unambiguously welcome development, both for what it signals about the improvement in underlying real economic activity and the hope it holds out for the health of the corporate and banking sectors.