Part I

- Ten New Economic Facts on Indian Economy

Economic Survey

- The Department of Economic Affairs, Finance Ministry of India presents the Economic Survey.

- The Chief Economic Adviser, Finance Ministry guides in its preparation.

- It is presented in the parliament every year, just before the Union Budget.

- The survey is the finance ministry’s view on the annual economic development of the country over the previous 12 months.

- It highlights the prospects of the economy in the short to medium term.

- It also summarizes the performance on major development programs, and highlights the policy initiatives of the government.

10 New Economic Facts on Indian Economy

- The Economic Survey highlights 10 new economic facts on the Indian economy based on the new data. They are as follows:

- Goods and Services Tax - GST has led to a 50% increase in the number of indirect taxpayers.

- There has been an increase in individual income tax filers as well.

- There has also been a large increase in voluntary registrations.

- This is especially in regards with small enterprises that buy from large enterprises.

- Availing the benefit of input tax credits was a major reason.

- The fear of undermined tax collections for states due to GST transition is allayed.

- Accordingly, the distribution of the GST base among the states got closely linked to the size of their economies.

- Formal Sector payroll - India’s formal sector, especially formal non-farm payroll, is substantially greater than believed.

- "Formality" was earlier defined in terms of social security provisions like EPFO/ESIC.

- It is now being defined in terms of being part of the GST net.

- This has increased the formal sector payroll share to 53% from the earlier 31% of the non-agricultural work force.

- Exports of states - Economic Survey, for the first time, deals with data on the international exports of states.

- The data indicates a strong correlation between export performance and states’ standard of living.

- States that export internationally and trade with other states were found to be richer.

- 5 States of Maharashtra, Gujarat, Karnataka, Tamil Nadu and Telangana account for 70% of India’s exports.

- India’s internal trade is about 60% of the GDP.

- This is comparatively greater than last year’s survey as well as other large countries.

- India’s exports - The largest firms in India account for a much smaller share of exports than in other comparable countries.

- Evidently, top 1% of Indian firms accounts only for 38% of exports.

- This is unlike the 50-70% as in countries like Brazil, Germany, Mexico and USA.

- The relatively smaller share by larger firms in India makes the firm export structure of India more egalitarian.

- This is indicative of a better contribution from the smaller firms than in other countries.

- Ready-made garments - The Rebate of State Levies (ROSL) was announced in 2016.

- Under the RoSL, the Centre gives garment exporters refunds against all the levies they shell out at the state level.

- The relief was offered under the duty drawback scheme as part of the package for the garments industry in the GST regime.

- The incentive package boosted exports of ready-made garments by about 16%.

- Male child preference - The survey highlighted that Indian society still exhibited a strong desire for a male child.

- It pointed out that most parents continued to have children until they get number of sons.

- The survey brings out that this was resulting in skewed sex ratios.

- Tax Litigation - There is substantial avoidable litigation in the tax arena which government action could reduce.

- The tax department's petition rate is high, but its success rate in litigation is low and declining (well below 30%).

- A smaller share of total pending cases accounted for a larger share of the money value at stake (due to the tax dispute). E.g.

- 0.2% of pending cases - 56% of the value at stake

- 66% of cases (each less than Rs 10 lakh) - 1.8% of the value at stake

- Growth and Investment - It was highlighted that growth in savings did not bring economic growth.

- But the growth in investment did bring a substantial growth to the economy.

- The survey thus emphasizes that raising investment was more important than raising savings.

- Direct tax collection - Direct tax collections by States are significantly lower than those of their counterparts in other federal countries.

- Indian states and other local governments empowered for tax collection realise lesser collection than their actual potential.

- Climate change - Extreme temperature increases and deficiency in rainfall have been recorded as footprints of climate change.

- These have adversely impacted agricultural yields of the country.

- The impact was found to be twice as large in un-irrigated areas as in irrigated ones.

Part II

What's in it?

- Economic Growth

- Inflation

- Monetary Management

- Tax Collections

- Banking Sector

- External Sector

- Foreign Direct Investment

- Trade Policy

- Industrial Sector

- Ease of Doing Business

- Services Sector

Economic Growth

- Projections - The survey forecasts real GDP growth to reach 6.75% this fiscal.

- It is projected to rise to 7 - 7.5% in 2018-19.

- There was a reversal of the declining trend of GDP growth in the second quarter of 2017-18, led by the industry sector.

- This could re-instate India as the world’s fastest growing major economy.

- The Gross Value Added (GVA) at constant basic prices is expected to grow at 6.1 % in 2017-18, as against the 6.6% in 2016-17.

- Agriculture, industry and services sectors are expected to grow at 2.1, 4.4 and 8.3 percentages respectively in 2017-18.

- Factors - The growth projections were based on the various reform measures undertaken in the recent years.

- It includes GST, resolution of the Twin Balance Sheet (TBS) problem through IBC, recapitalization package for PSBs.

- Also, with liberalization of FDI and export uplift from the global recovery, the economy began to accelerate in the second half.

- Comparative performance - India's average GDP growth during last 3 years is around 4 percentage points higher than the global growth.

- India's growth averaged to 7.3% in 2014-15 to 2017-18 period.

- Lower inflation, improved current account balance and reduction in the fiscal deficit to GDP ratio are notable factors behind.

- The survey thus points out that India can be rated as among the best performing economies in the world.

- Way Ahead - The agenda for the next year to ensure a favourable growth trend has been charted out as:

- stabilizing the GST

- completing the TBS actions

- reducing unviable banks and allowing greater private sector participation

- privatizing Air India

- staving off threats to macro-economic stability

- Over the medium term, three areas of policy focus are spelt out:

- Employment - for the young and burgeoning workforce, especially women

- Education - creating an educated and healthy labour force

- Agriculture - raising farm productivity and strengthening agricultural resilience

Inflation

- Headline - The Consumer Price Index (CPI) based headline inflation averaged to 3.3% during 2017-18.

- Many states have also witnessed a sharp fall in CPI inflation during 2017-18.

- Trend -This is notably the lowest in the last six financial years.

- It has been below 4% for twelve straight months, from November, 2016 to October, 2017.

- It indicates a gradual transition from a period of high and variable inflation in the last four years to more stable prices.

- Food - The CPI food inflation averaged around 1% during April-December in the current financial year.

- This has been possible due to Good agricultural production coupled with regular price monitoring by the Government.

- However, the recent rise in food inflation is mainly due to factors driving prices of vegetables and fruits.

- Factors - The decline in inflation was broad-based across major commodity groups except Housing and Fuel & Light.

- In rural areas food was the main driver of CPI inflation.

- In urban areas, housing sector contributed the most.

Monetary Management

- Repo Rate - Monetary policy during 2017-18 was conducted under the revised statutory framework that provided for the MPC.

- The Monetary Policy Committee (MPC) decided to reduce the policy Repo Rate by 25 basis points to 6%, in August.

- Monetary policy has remained steady during 2017-18 with only one policy rate cut made in August.

- Liquidity - Post the demonetisation in November 2016, the re-monetisation process began from November, 2017.

- This set in a favourable base effect.

- Resultantly, the Y-o-Y growth of both Currency in Circulation and M0 turned sharply positive.

- This is higher than their respective growth rates in the previous year.

- Liquidity conditions largely remain in surplus mode.

Tax Collections

- The data on central finance is made available by The Controller General of Accounts (CGA).

- Accordingly, the growth in direct tax collections of the Centre was at 13.7% during April-November 2017.

- The indirect taxes growth rate was 18.3% during the same period.

- The States’ share in taxes grew by 25.2%.

- This is much higher than the growth in net tax revenue (to Centre) at 12.6% and of gross tax revenue at 16.5 %.

- There is a 50% increase in the number of indirect tax payers.

- In all, the Gross Tax Collections during the first 8 months of 2017-18 period are reasonably on track.

- There was a slow pace in non-tax revenue but the robust progress in disinvestment compensated for this.

Banking Sector

- NPA - Banking sector performance, the PSBs in particular, continued to be subdued in the current financial year.

- The Gross Non-Performing Advances (GNPA) ratio of Scheduled Commercial Banks increased from 9.6% to 10.2% (Mar-Sep 2017).

- The new Insolvency and Bankruptcy Code mechanism is being used actively to resolve the NPA problem of the banking sector.

- Credit - Non Food Credit (NFC) grew at 8.85% in November 2017 as compared to 4.75% in November 2016.

- Non Food Credit refers to credit or loan provided other than to the FCI (Food Corporation of India).

- Bank credit lending to Services and Personal Loans (PL) segments continues to be the major contributor to overall NFC growth.

- The NBFC sector, as a whole, accounted for 17% of bank assets and 0.26% of bank deposits as on Sep 30, 2017.

- Primary market - The year 2017-18 (April-November) witnessed a steady increase in resource mobilisation in the primary market segment.

- The 10 year G-sec yield has risen sharply in the recent period.

- The stock markets also hit record highs this financial year.

External Sector

- India’s external sector continued to be resilient and strong in 2017-18.

- International Developments - The global economy is expected to accelerate from 3.2% in 2016 to 3.6% in 2017 and 3.7% in 2018.

- It reflects an upward revision of the earlier projections by IMF.

- BoP - India’s balance of payments situation continued to be favourable in the first half of 2017-18 as since 2013-14.

- CAD - This is despite some rise in the Current Account Deficit (CAD) in the first quarter (Q1).

- India’s CAD stood at US $7.2 billion in Q2 of 2017-18.

- This translates to 1.2% of the GDP.

- It is a sharp decline from 2.5% of GDP in the preceding quarter.

- Trade Deficit - India’s trade deficit (on custom basis) had widened.

- It stood at US$ 74.5 billion in the first half of 2017-18.

- This is against a declining trend in CAD observed since 2014-15.

- In 2017-18 (April-December) trade deficit (on custom basis) shot up by nearly 46%.

- It now stands at US$ 114.9 billion.

- The POL (petroleum, oil and lubricants) deficit and non- POL deficit has grown by nearly 27% and 65% respectively.

- Composition of Trade - 2017-18 (April-November) witnessed a mixed growth trend in terms of major sectors.

- Engineering goods, and petroleum crude and products registered a good export growth.

- Chemicals & related products and textiles & allied products witnessed a moderate growth.

- However, a negative growth was recorded by the gems and jewellery.

- Prospects - The prospects for India’s External Sector in this and coming year look bright.

- The world trade is projected to grow at 4.2 % and 4% in 2017 and 2018 respectively, as against 2.4% in2016.

- The trade of major partner countries is improving, and India’s export growth is also picking up.

- However, rise in oil prices is emphasized as a huge challenge in the coming period, posing a downside risk to trade.

- However, this could also lead to higher inflow of remittances which have already started picking up.

- Supportive policies like the GST, logistics and trade facilitation policies could help balance the risks.

Foreign Direct Investment

- FDI equity inflows registered a 0.8% growth in total during 2017-18 (April-October).

- But FDI Equity Inflows to the Services sector grew by 15%.

- This is mainly due to higher FDI in two sectors i.e. Telecommunications and Computer Software and Hardware.

- 25 sectors also including services activities and covering 100 areas of FDI policy have undergone reforms recently.

- At present, more than 90% of FDI inflows are through automatic route.

- The reforms have positively contributed to higher FDI inflow.

Trade Policy

- Two important developments on the trade policy front during the year relate to:

- mid-term review of Foreign Trade Policy (FTP)

- multilateral negotiations of WTO in December 2017

- Besides, some developments on the trade logistics front and anti dumping measures are worth mentioning.

- Foreign Exchange Reserves - India’s foreign exchange reserves reached US$ 409.4 billion on end-December 2017.

- It is a growth by nearly 14% on a y-o-y basis from end December 2016.

- Major economies are running a current account deficit.

- Given this, India is 6th largest foreign exchange reserve holder among all countries of the world.

- The import cover of India’s foreign exchange reserves was 11.1 months at end-Sep 2017 (11.3 months at end March 2017).

- Import cover is the number of months of imports that could be supported by a country's international reserves.

Industrial Sector

- IIP - Index of Industrial Production (IIP) (base year 2011-12) indicates industrial output increase of 3.2 % (April-Nov 2017-18).

- This was a composite effect of robust growth in electricity generation and moderate growth in both mining and manufacturing sectors.

- The IIP registered a 25-month high growth of 8.4% with manufacturing growing at 10.2%.

- Core Industries - The 8 Core Infrastructure Supportive Industries had a cumulative growth of 3.9%(Apr-Nov 2017-18).

- They eight core industries are:

- Coal

- Crude Oil

- Natural Gas

- Petroleum Refinery Products

- Fertilizers

- Steel

- Cement

- Electricity

- The production growth of Coal, Natural Gas, Refinery Products, Steel, Cement and Electricity was positive during this period.

- While the production of crude oil and fertilizers fell marginally.

- Performance indicators - International ratings agency Moody’s upgraded India’s sovereign bond rating for first time in more than a decade.

- India ranked 100 out of 190 countries in Ease of Doing Business of the World Bank Report 2018.

- This is an increase of 30 positions over last year’s rank.

- The upgrades are attributed to recent reform measures.

- Reforms - These include the GST, IBC, and announcement of bank recapitalization.

- Make in India programme, Start-up India and Intellectual Rights Policy to boost industrial growth are also the reasons.

- Notable sectoral initiatives include anti-dumping duty, Minimum Import Price (MIP) on a number of items for the steel sector and Pradhan Mantri Mudra Yojana for the MSMEs.

- Suggestions - The survey calls for promoting inclusive employment-intensive industry.

- This, along with building resilient infrastructure are said to be vital factors for economic development.

Ease of Doing Business - Judiciary

- Status - India jumped 30 places to enter the top 100 for the first time in the World Bank’s Ease of Doing Business Report, 2018.

- It leaped 53 and 33 spots in the taxation and insolvency indices, respectively; an outcome of taxation reforms and IBC, 2016.

- India also registered uptrends in protecting minority investors and obtaining credit, facilitation of electricity, etc.

- Concerns - High number of delays and pendency of economic cases in Supreme Court, Economic Tribunals and Tax department.

- This is reflecting in terms of stalled projects, mounting legal costs, contested tax revenues and reduced investment.

- These concerns hamper dispute resolution and contract enforcement.

- Government Measures - The Government has taken a number of actions to improve the contract enforcement regime including:

- Scrapping of over 1,000 redundant legislations

- Amending the Arbitration and Conciliation Act, 2015

- Commercial Courts Commercial Divisions and Commercial Appellate Division of High Courts Act, 2015

- Expanding the Lok Adalat Programme

- The Judiciary has also expanded the National Judicial Data Grid (NJDG).

- This is near to ensuring that every High Court is digitized.

- Suggestions - The Survey suggests coordinated action between government and the judiciary.

- It calls for a Cooperative Separation of Powers between judiciary on one hand and executive/legislature on the other.

- This is a horizontal variant of the vertical cooperation between the Centre and States (Cooperative Federalism) in case of GST.

- The Survey also suggests to consider efforts for alleviating pendency in the lower judiciary as a performance-based incentive for States.

- Other suggestions in this regard include:

- expanding judicial capacity in lower courts and reducing existing burden on HCs and the SC

- limited appeals by tax department considering its low success rate

- increasing state expenditure on judiciary, especially for modernization and digitization

- focussing on internal specialization and efficiencies of SC by creating more subject-matter and stage-specific benches

- prioritizing stayed cases, and imposing stricter timelines by courts, especially when involving government infrastructure projects

- improving Courts Case Management and Court Automation Systems

Services Sector

- State-wise - The Survey gave a unique State-wise comparison of the performance of the Service sector in India.

- Out of the 32, in 15 states and UTs, the Services Sector is the dominant sector.

- It has contributed more than half of the Gross State Value Added (GSVA).

- However, there is wide variation in terms of share and growth of services GSVA in 2016-17.

- Services GSVA share ranges from over 80% in the case of Delhi and Chandigarh to around 31% in Sikkim.

- Services GSVA growth ranges from 14.5% as in Bihar to 7% in UP.

- National - The services sector continued to be the key driver of India’s economic growth.

- It has a share of nearly 55% in India’s Gross Value Added (GVA).

- Evidently, it contributed almost 72.5 % of GVA growth in 2017-18.

- Some of the notable areas include Tourism, Information Technology-Business Process Management, Real Estate, R&D, and Space.

- Exports - India’s services sector registered an export growth of 5.7% in 2016-17.

- India remained the 8th largest exporter in commercial services in the world in 2016.

- It comes with a share of 3.4% globally.

- This is double the share of India’s merchandise exports in the world which is 1.7%.

- Both growths in services exports and services imports were robust.

- Resultantly, the Net services receipts rose by 14.6% during first half of 2017-18.

- The Net surplus in the services financed about 49% of India’s merchandise deficit in this period.

- Increase in incentives under Services Exports from India Schemes (SEIS) contributed to services growth considerably.

- Enhanced global uncertainty, protectionism and stricter migration rules would be key challenges in shaping future services exports.

Part III

What to look for?

- Infrastructure

- Agriculture

- Climate Change

- Sustainable Development

- Air Pollution

- Social Expenditure

- Education

- Labour Reforms And Participation

- Pink-Colour Economic Survey - Gender Issues

INFRASTRUCTURE

- Status - The Economic Survey draws attention to the Global Infrastructure Outlook.

- It forecasts around US$ 4.5 trillion worth of investments for India till 2040 to develop infrastructure.

- This is said to be essential for both economic growth and community wellbeing.

- India certainly lags behind many emerging economies in terms of providing qualitative transportation related infrastructure.

- Roadways - The primary agenda has been building new National Highways (NHs) and converting State Highways (SHs) into NHs.

- But, States with lower Per capita GSDP have low density of Other Public Work Department (OPWD) Road/District Road.

- Addressing this is essential to provide better access and thereby enhancing economic activities.

- Government has taken steps for streamlining of land acquisition and environment clearances to expedite delayed projects.

- The umbrella programme ‘BharatmalaPariyojana’ aims to achieve optimal resource allocation for holistic highway development.

- Railways - Railways showed an increase of over 5% in revenue- earning freight traffic carrying during 2017-18 (upto Sep 2017).

- The pace of commissioning Broad Gauge (BG) lines and completion of electrification have been accelerated.

- Over 400 kms of metro rail systems are operational across the country.

- And another 680 kms (appx.) are under construction in various cities across India.

- Ports - The port-led development along Indian coast line is undertaken under SagarmalaProgramme.

- Almost 289 Projects worth over Rs. 2 Lakh Crore are under various stages of implementation and development.

- The cargo traffic handled at Major Ports has shown a marginal increase in the last year, valuing to around 500 million tonnes.

- Telecommunication - The Survey made mention of programmes like ‘Bharat Net’ and ‘Digital India’.

- It expressed hope that these could convert India into a digital economy.

- Out of around 1200 million total subscribers, roughly 500 and 700 million connections were in the rural and urban areas respectively.

- Civil Aviation - Domestic airlines has showed a growth rate of 16% in 2017-18 (April - Sep 2017) over the previous year period.

- This is in terms of increase in passenger carrying.

- Initiatives like liberalization of air services, airport development and regional connectivity through scheme like UDAN are being taken up.

- Power - All-India installed power generation capacity has reached well over 3.3 lakh MW till Nov, 2017.

- The Ujjawal DISCOM Assurance Yojana (UDAY) has focused on enhancing the financial health of DIStribution COMpanies.

- It has reduced their interest burden, cost of power and aggregated technical and commercial losses.

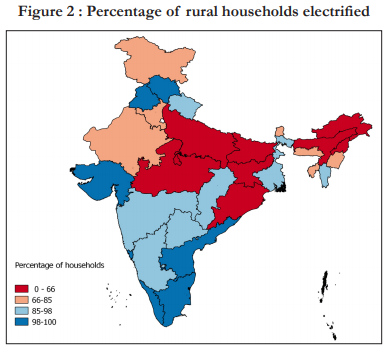

- Electrification in 15,183 villages has been completed.

- Saubhagya (Pradhan Mantri Sahaj Bijli HarGhar Yojana), was launched in September 2017.

- This is to ensure electrification of all remaining willing households in the country in rural and urban areas.

- Logistics - The Indian logistics industry has grown at a compound annual growth rate (CAGR) of 7.8% during the last five years.

- The logistics sector provides employment to more than 22 million people.

- In World Bank’s 2016 Logistics Performance Index India improved to 35th rank in 2016 from 54th in 2014.

- Housing - India’s housing policies have been mostly focused on building more homes and on home ownership.

- The Economic Survey suggests a more holistic approach taking into account rentals and vacancy rates.

- In turn, this needs attention on contract enforcement, property rights and spatial distribution of housing supply vs. demand.

AGRICULTURE

Feminisation

- Feminisation - The Economic Survey points to a trend of ‘feminisation’ of agriculture sector.

- This is a consequence of growing rural to urban migration by men.

- There is an increasing number of women in multiple roles as cultivators, entrepreneurs, and labourers.

- They make presence at all levels of the agricultural value chain.

- It includes production, pre-harvest, post-harvest processing, packaging, and marketing.

- Significance - Globally, empirical evidence suggests the decisive role of women in ensuring food security and preserving local agro-biodiversity.

- Rural women are responsible for the integrated management and use of diverse natural resources to meet the daily household needs.

- Importantly, the entitlements of women farmers will be the key to improve agriculture productivity.

- Measures - The following measures have been taken to ensure mainstreaming of women in agriculture sector:

- earmarking at least 30% of the budget allocation for women beneficiaries in all ongoing schemes and initiatives

- initiating women centric activities to ensure benefits of various beneficiary-oriented programs/schemes reach them

- focusing on women self-help groups to connect them to micro-credit, ensuring representation in decision-making bodies

- declaring 15th October of every year as Women Farmer’s Day, acknowledging the role of women in agriculture

- Way ahead - Women farmers' enhanced access to resources like land, seeds, water, credit, markets, technology and training is a necessity.

- India needs an ‘inclusive transformative agricultural policy’ aimed at gender-specific intervention.

Mechanisation

- Trend - The survey highlights that Indian Farmers were adapting to farm mechanization at a faster ratein comparison to recent past.

- Indian tractor industries have emerged as the largest in the world.

- They account for about 1/3rd of total global tractor production.

- The sale of tractors to a great extent reflects the level of mechanization.

- In 1960-61, about 93% farm power was coming from animate sources, which has reduced to about 10%in 2014-15.

- On the other hand, mechanical and electrical sources of power have increased from 7% to about 90%during the same period.

- Need - According to the World Bank estimates, half of the Indian population would be urban by the year 2050.

- It is estimated that the percentage of agricultural workers in total work force be around 25% by 2050.

- This is a huge drop from about 58 in 2001.

- Moreover, intensive involvement of labour in different farm operations makes the cost of production of many crops quite high.

- All these call for a more enhanced level of farm mechanization in India.

- Suggestion - Institutionalization through custom service or a rental model is suggested for availing high cost farm machinery.

- It could be adopted by private players or State or Central Organization in major production hubs.

- This is significant to reduce the cost of operation.

Land Holdings Consolidation

- There is predominance of small operational holding in Indian Agriculture.

- The survey thus stresses the need for land holdings consolidation.

- This is especially essential for reaping the full benefits of agricultural mechanization.

Interest Subvention

- A sum of around Rs.20,ooo crore has been approved in 2017-18 to meet various obligations arising from interest subvention.

- This includes those provided to the farmers on short term crop loans and also loans on post-harvest storages.

- These credits meet an important input requirement, especially those of small and marginal farmers who are the major borrowers.

- The Survey adds that institutional credit helps delinking farmers from non-institutional sources of credit (at high rates of interest).

- Moreover, the crop insurance under Pradhan Mantri Fasal Bima Yojana (PMFBY) is being linked to availing of crop loans.

- Both of this would give farmers the combined benefit.

Market Reforms

- e-Nam - The electronic National Agriculture Market (e-NAM) was launched by Government on April, 2016.

- It aims at integrating the dispersed APMCs (Agricultural Produce Market Committee) through an electronic platform.

- It enables price discovery in a competitive manner to offer remunerative prices to farmers for their produce.

- KCC - The Survey stresses the need for small and marginal farmers to hold their Kisan Credit Card(KCC).

- This is to avail post-harvest loans by storing their produce in the accredited warehouses.

- Loans at interest subvention of 2% on such storages for a period of upto 6 months are offered.

- This is essential to supplement the market reforms and sell when the market is buoyant, and avoid distress sale.

Farmers' Income

- Economic Survey emphasizes the Government's goal to double farmers' income by 2022.

- The credit from institutional sources will complement all government initiatives in this regard.

- These include Soil Health Card, Input Management, Per Drop More Crop in Pradhan Mantri Krishi Sinchai Yojana (PMKSY), PMFBY, e-Nam, etc.

Innovation

- Agricultural R&D is reiterated as the main source of innovation for sustaining agricultural productivity growth in the long-term.

- The actual expenditure of Department of Agricultural Research and Education/ICAR has increased during 2010-11 to 2017-18.

- The compound annual growth rate of expenditure has been 4.2% over the years.

- During the current year (2017-18), investment in Agriculture Research and Education protected new Agricultural innovation.

- Evidently, there was significant number of patent applications at Indian patent Office (IPO).

- Also, copyright and trademark applications filed by ICAR for products and processes.

- New Varieties/hybrids tolerant to biotic and abiotic stresses were released for cultivation in different agro-ecologies of the country.

- These have been developed for Cereals, Pulses, Oilseeds, commercial crops and Forage crops (for use as feed for animals).

CLIMATE CHANGE

- Commitments - Survey lays emphasis on India’s commitment to environment and response to the threat of climate change.

- This is in accordance with the principles of equity and Common But Differentiated Responsibilities.

- Also, with the “Paris Pledge” to reduce the emission intensity of GDP by 33-35% over 2005 levels by the year 2030.

- Measures - The survey mentions the establishment of 8 Global Technology Watch Groups to keep track of the state-of –the-art technologies emerging globally.

- It is part of the National Mission on Strategic Knowledge for Climate Change (NMSKCC).

- This is one of the 8 missions under the National Action Plan on Climate Change.

- Also, the extension of Climate Change Action Programme launched in 2014 for the period 2017-18 to 2019-20.

- It also make note of the continuation of National Adaptation Fund on Climate Change till 31st March 2020 with additional financial allocation.

SUSTAINABLE DEVELOPMENT

- Urban India - India’s urban population is projected to grow to about 600 million by 2031.

- How cities, the centres of economic activity, deliver on varied basic services will determine the path and progress of sustainable development.

- The survey thus suggests Urban Local Bodies to generate resources through varied financial instruments.

- These include municipal bonds, PPPs and credit risk guarantees.

- Renewable energy - The Survey states access to sustainable, modern and affordable energy as the basis of achieving Sustainable Development Goals.

- The increasing share of renewables has tripled in the last 10 years.

- As on 30th November 2017, the share of renewable energy sources was 18% in the total installed capacity of electricity in the country.

- International Solar Alliance (ISA) entered into force in December, 2017.

- The coalition paves the way for future solar generation, storage and good technologies for each member country’s individual needs.

AIR POLLUTION

- Delhi - The Survey expresses concern over air pollution in Delhi with the onset of winter due to various factors.

- It ascribes four main reasons for Delhi’s worsening air quality:

- crop residue, biomass burning

- vehicular emissions and redestributed road dust

- industries, power plants

- winter temperature inversion, humidity and absence of wind

- Suggestion - Coordination between agencies and Central and State, sustained civic engagement is recommended.

- Using satellite-based tools to detect fires, penalties on burning of agricultural waste, congestion pricingfor vehicles are taken up.

- Improving public transport system and modernized bus fleets, phasing out old vehicles, accelerating BS-VI are other measures.

- Further, use of technology to convert agricultural waste into usable fodder or bio-fuels, shift to non-paddy crops, straw management system are also suggested.

- Agricultural cooperatives and local bodies are called for increased roles in implementation.

- Indoor pollution - The survey mentions the adverse impact of indoor pollution on women and children.

- It accentuated the need for access to modern energy sources.

- Measures - Pradhan Mantri Ujjwala Yojana was launched in 2016 to provide 80 million LPG connections by 2020 to BPL households.

- Ujjwala Plus complements the above, to address the cooking needs of deprived people not covered under the Socio-Economic Caste Census (SECC) 2011.

- The Deen Dayal Upadhyaya Gram Jyoti Yojana was launched in 2015 to achieve 100% village electrification.

SOCIAL EXPENDITURE

- Expenditure on Social services by the Centre and States as a proportion of GDP stands at 6.6% in 2017-18 (BE).

- Components-based expenditure on social services in relation to GDP in 2017-18 (BE):

- Education - 2.7%

- Health - 1.4%

- Others - 2.6%

- Significance - Priority to social infrastructure are stated as essentials to inclusive and sustainable growth.

- Bridging the gender gaps in education, skill development, employment earnings, reducing social inequalities find mention in the survey.

- These are emphasized as underlying goals of development strategy and to grow as a leading knowledge economy.

EDUCATION

- The Survey highlights India’s commitment to achieve the Sustainable Development Goal (SDG- 4) for education.

- RTE Act, 2009 is an initiative towards the goal of universalization of elementary education.

- There is substantial improvement in the enrolment and completion rates of education in both primary and elementary school.

- There is also an increased percentage of schools which comply with Student Classroom Ratio (SCR) and Pupil Teacher Ratio (PTR) at the all India level.

- However, there are inter-state variations in adherence to SCR and PTR norms.

- Gender Parity Index (GPI) at the primary and secondary levels of school has shown improvement.

- This is attributed to the success of programmes like Beti Padhao, Beti Bachao in addressing gender bias in access to education.

LABOUR REFORMS AND PARTICIPATION

- Initiatives - The Survey mentions the technology enabled transformative initiatives such as:

- Shram Suvidha Portal (facilitate reporting of Inspections, and submission of Returns)

- Ease of Compliance (to maintain registers under various Labour Laws/Rules)

- Universal Account Number

- National Career Service portal (linking all employment exchanges)

- These aim at reducing complexity in compliance and bringing transparency and accountability in labour laws enforcement.

- Maternity Benefit (Amendment) Act, 2017, offers women entitlement to enhanced maternity leave for a period of 6 months.

- Mahila E-Haat is launched to provide e-marketing to products made/manufactured/sold by women entrepreneurs/SHGs/NGOs.

- Legislation - The legislative reforms in Labour sector include rationalizing 38 Central Labour Acts into 4 labour codes.

- They are the Codes on Wages, Safety and Working Conditions, Industrial Relations, Social Security and Welfare.

- Creation of employment opportunities and providing sustainable livelihoods for those in informal economy are the prime objectives.

- Gender Gap - India's gender gap in labour force participation rate is more than 50 percentage points.

- This is relatively high among many developing countries.

- Women workers are the most disadvantaged in the labour market as they:

- constitute a very high proportion among the low skilled informal worker category

- engaged in low-productivity and low paying work

- The lower participation of women in economic activities adversely affects the growth potential of the economy.

- Political participation of women, in a country like India with around 49% of women in the population, has been low.

- As per the 'Women in Politics' 2017 report:

- Lok Sabha - 11.8% women MPs

- Rajya Sabha - 11% women MPs

- Moreover, only 9% of MLAs across the country are women.

- Notably, there are developing countries like Rwanda which has more than 60% women representatives in Parliament.

- Nai Roshni (leadership development programme for benefiting the women belonging to minority communities) is operational.

- Mahila Shakti Kendra scheme has been launched for leadership development and to address women’s issues at village levels.

- MGNREGA - The Survey mentions that there has been highest ever budget allocation under MGNREGA during 2017-18.

- About 4.6 crore households were provided employment under the Mahatma Gandhi National Rural Employment Guarantee Act.

- Out of this, 54% were generated by women, 22% by Schedule Castes and 17% by Schedule Tribes, indicating the social reach.

PINK-COLOUR ECONOMIC SURVEY - GENDER ISSUES

- Pink - The colour was chosen as a symbol of support for the growing movement to end violence against women.

- The survey lays special emphasis on Gender and Son meta-preference.

- Implicit in adopting pink is the assumption that it is the colour preferred by women.

- However, this in itself is argued as a gender stereotype.

- Various studies have proven wrong the notion that pink colour was the favoured colour of women.

- Multi-dimensional Assessment - Assessments have been made based on three specific dimensionsof gender namely:

- Agency (women’s ability to make decisions on reproduction, spending on themselves and on their households, their own mobility and health).

- Attitudes (attitudes about violence against women/wives, ideal number of daughters preferred relative to the ideal number of sons).

- Outcomes (‘son preference’ measured by sex ratio of last child, female employment, choice of contraception, education level, age at marriage, age at first birth, physical or sexual violence experienced by women).

- In the last 10-15 years, India’s performance improved on 14 out of 17 indicators of women’s agency, attitudes, and outcomes.

- India lags on indicators such as employment, son preference and use of reversible contraception (contraception for an extended period without requiring user action).

- Heterogeneity - The North-Eastern states continue to be a model for the rest of the country.

- Hinterland states are lagging behind in aspects of gender equality.

- Worryingly, some southern states do less well than their development levels would suggest.

- Son preference - 'Son Meta-Preference' is where parents continue to have children until they have the desired number of sons.

- Meta-preference was measured using an indicator called sex ratio of the last child (SRLC).

- Certainly, SRLC was heavily skewed in favour of boys.

- This meta-preference leads to the notional category of 'unwanted' girls which is estimated at over 21 million.

- The adverse sex ratio of females to males has led to 63 million "missing" women (difference in actual and expected number of women).

- Beti Bachao, Beti Padhao, Sukanya Samridhi Yojana schemes, and mandatory maternity leave rules are all steps in addressing these shortfalls.

Part IV

What to look for?

- Health

- Sanitation

- Fiscal Federalism

- Financial Savings And Investment

- Science & Technology

- Net Producer Of Knowledge

- 'Late Converger Stall'

HEALTH

- The Survey reiterates India’s commitment to achieve the targets under Sustainable Development Goals-3 (SDG-3).

- Some of the goals are aligned with the National Health Policy 2017.

- The Policy recommends increasing State sector health spending to more than 8% of the States’ Government Budget by 2020.

- Strengthening health delivery systems and achieving universal health coverage are the objectives.

- Expenditure - Government healthcare providers accounted for about 23% of the Current Health Expenditure (CHE).

- This reflects the prominence of private hospitals and clinics among health care providers.

- OoPE - Out of Pocket Expenditure (OoPE) has declined approximately 7 percentage points during 2004-05 to 2014-15.

- However, its share is still around 62% in total health expenditure.

- The higher levels of Out of Pocket Expenditure (OoPE) on health adversely impact the poorer sections and widen then inequalities.

- Lack of affordable diagnostic facilities consumes a significant part OoPE.

- Average prices of diagnostic tests widely vary across cities, despite government's efforts to regulate prices of Drugs and Diagnostics.

- DALYs - The concept of Disability Adjusted Life Years (DALYs) helps analyse the disease burden and associated risk factors.

- It is the sum of years of potential life lost due to premature mortality and the years of productive life lost due to disability.

- The Survey advocates understanding the efficiency of public spending with respect to DALYs behaviour across major States.

- This is to assess whether high spending by States on health results in better health outcomes.

- LEB - There has been significant improvement in the health status of individuals in India.

- Evidently, life expectancy at birth has increased by 10 years during the period from 1990 to 2015.

- States with higher life expectancy are reflecting lower DALYs rates i.e. lower incidence of diseases and vice-versa.

- Risk factors - Malnutrition still remains the most important risk factor, despite the drop in rate from 1990.

- Integrated Child Development Services, Pradhan Mantri Matru Vandana Yojana, National Nutrition Mission are efforts at addressing this.

- The contribution of air pollution to disease burden is high in India with levels of exposure remaining among the highest in the world.

- Pradhan Mantri Ujjwala Yojana is a measure in this regard.

- The other key risk factors include dietary risks, high blood pressure and diabetes etc.

- The Survey points to a shift in disease burden from Communicable Diseases to Non-Communicable Diseases over last two decades.

- Way Ahead - The disease burden can be reduced substantially, if the risk factors related to health loss are addressed effectively.

- Also, ensuring the efficiency in use of resources towards health care is essential to translate expenditure into improved outcomes.

- In this context, the increase in use of antibiotics and resultant Antimicrobial resistance is a cause for concern.

SANITATION

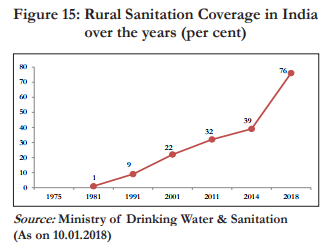

- The Survey asserts the importance of quality of hygiene and sanitation for improving the health outcomes.

- Coverage - Sanitation coverage in rural India is stated to have increased from 39% in 2014 to 76% in January, 2018.

- It is mainly attributed to Swachh Bharat Mission (SBM) (Gramin) launched in 2014.

- ODF - The number of persons defecating in open in rural areas has significantly declined, creating positive health and economic impact.

- So far, 296 districts and around 3 lakh villages all over India have been declared Open Defecation Free (ODF).

- 8 states (Sikkim, Himachal Pradesh, Kerala, Haryana, Uttarakhand, Chhattisgarh, Arunachal Pradesh, Gujarat) are declared ODF completely.

- 2 Union Territories (Daman & Diu and Chandigarh) also join this category.

- The NSSO and Quality Council of India's surveys reported more than 90% of individuals, who have access to toilets, using them.

- UNICEF report, ‘The Financial and Economic Impact of SBM in India’, estimated that a household in an ODF village saves Rs 50,000/- a year.

FISCAL FEDERALISM

Concern

- RLGs - The Survey highlights the low level of tax collections by the Rural Local Governments in India.

- RLGs received about 95% of their revenues from the devolved funds from the Centre/State.

- RLGs in India generate only about 6% of revenues from own resources compared to 40% in Brazil and Germany.

- ULGs - On the other hand, the urban local governments generate 44% of their total revenue from own sources.

- ULGs also collect 18% of total revenues from direct taxes, much closer to International norms.

- This highlights the difference in fiscal empowerment between urban local governments and rural local governments in India.

- Direct Taxes - Direct Taxes account for only about 35% in India as against 70% in Europe.

- Indian States generate only about 6% of their revenue from direct taxes as against 19% and 44% in Brazil and Germany respectively.

- Moreover, unlike in other countries, reliance on direct taxes in India seems to be declining.

- This trend will only be reinforced if GST proves to be a buoyant source of revenue.

- Development - Economic and political development has been associated with a rising share of direct taxes in total taxes.

- When countries rely on non-tax sources of government revenues, economic and institutional development could remain stunted.

Cause

- Some State Governments have not devolved enough taxation powers to the Panchayats.

- Notably, permissible taxes for Panchayats include Property and Entertainment Taxes but not Land Taxes or Tolls on roads.

- Even in cases where more powers are devolved, land revenue collection remained low.

- This is due to low base values applied to properties and also low rates of taxes levied.

- Other reasons that the Economic Survey suspects are

- unwillingness to tax by the state, possibly due to close proximity between the state and the citizens

- unwillingness by abled citizens to pay because of dissatisfaction with the quality of services they are receiving

- Centre and States' desire to use their devolution powers to control lower levels of government

Suggestion

- Low tax collections at lower levels are certainly posing a challenge in reconciling fiscal federalism and accountability.

- The Survey calls for better data and evidence to evaluate the impact of 73rd and 74th Constitutional Amendments.

- This is to assess the fiscal empowerment of Rural and Urban local governments, India’s federal structure, its governance and accountability.

- The Survey emphasized the importance of fiscal decentralization.

- Fiscal decentralization is grounded on the idea that spending and tax decisions must reflect local preferences as far as possible.

- This is essential to address the issue of low tier governments remaining stuck in a 'low equilibrium trap'depending largely on outside resources.

FINANCIAL SAVINGS AND INVESTMENT

- India witnessed an unprecedented climb to historic high levels of investment and saving rates in the mid-2000s.

- However, this has been followed by a gradual decline and slowdown still continues.

- Savings - The ratio of domestic saving to GDP fell from the peak 38.3% in 2007 to about 29% in 2016.

- Investment - In India, the investment slowdown started in 2012.

- There is an overall investment decline of the 6.3 percentage points over 2007-08 and 2015-16.

- Out of this, the private investment accounts for 5 percentage points.

- Trend in India- The current slowdown where both investment and saving have slumped is the first in India’s history.

- India’s current investment/saving slowdown episode has been lengthy compared to other cases and it still continues.

- The cumulative fall over 2007 and 2016 has been milder for investment than saving.

- However, India’s investment slowdown is unusual.

- It is so far relatively moderate in magnitude, long in duration, and started from a relatively high peakrate of 36% of GDP.

- Moreover, it has a specific nature, in that it is a balance sheet-related slowdown indicating financial stress of companies.

- Response - Policy priorities over the short run focused on mobilizing the locked up savings.

- This was through attempts like unearthing the black money and encouraging the conversion of gold into financial saving.

- Need - The share of financial saving is already rising in aggregate household saving.

- There is a clear shift visible towards market instruments, largely driven by demonetization.

- The concern is that, investment slowdowns are more detrimental to growth than savings slowdown.

- So, given the changing trend in savings side through recent measures, the need now is to focus more on investment revival.

- Suggestion - The policy conclusion is urgent prioritization of investment revival to arrest the more lasting growth impacts.

- This is essential for India to move towards 8-10% growth.

SCIENCE & TECHNOLOGY

- The Survey records transformation of Indian Science & Technology in the last one year in the outputs.

- Publications - In 2013, India ranked 6th in the world in scientific publications and its ranking has been increasing as well.

- The growth of annual publications between 2009 and 2014 was almost 14%.

- This growth increased India’s share in global publications from 3.1 % in 2009 to 4.4 % in 2014.

- Broadly, the publication trends reveal that India is gradually improving its performance.

- In addition to increasing publications, trends in quality are also stated to be slowly improving.

- The Nature Index that assesses counts of high-quality research outputs ranked India at 13 in 2017.

- Patents - According to the WIPO, India has the world’s 7th largest Patent Filing Office.

- However, India produces fewer patents per capita.

- One major challenge in India has been the domestic patent system.

- While India’s patent applications and grants have grown rapidly in foreign jurisdictions, the same is not true at home.

- Indian residents were granted over 5000 patents in foreign offices in 2015.

- But the number of resident filings in India was little over 800.

- Residential applications have increased substantially since India joined the international patent regime in 2005.

- However, the number of patents granted fell sharply post-2008 and has remained low.

- Measures - The government has recently hired over 450 additional patent examiners.

- It has also created an expedited filing system for Indian residents in 2017, which are welcome interventions.

- Beyond patent filing side, addressing patent litigation issues will be crucial to ensure patent system effectively rewards innovation.

NET PRODUCER OF KNOWLEDGE

- The Survey calls for the need to gradually move from being a net consumer of knowledge to becoming a net producer.

- There is a sluggish pace and expansion of scientific research and knowledge on the one hand.

- On the other hand, generally higher importance is given to careers in engineering, medicine, management and government jobs.

- India thus needs to rekindle the excitement and purpose that would attract more young people to scientific enterprise.

- Laying this knowledge foundation is essential to address some of India’s most pressing development challenges.

- Investing in science is also fundamental to India’s security:

- the human security of its populations

- national security challenges from emerging threats ranging from cyber warfare to autonomous military systems

- the resilience to address the multiple uncertainties due to climate change

LATE CONVERGER STALL

- What - The present era is one of 'economic convergence'.

- It is a condition where the poorer countries have grown faster than richer countries and closed the gap in standards of living.

- E.g. India moved from being a low income country in 1960 to a lower middle income country in 2008.

- It is now attempting to make a transition to middle income status.

- Notably, India is one among the countries that are trying to make this transition after the global financial crisis (2008).

- There are now apprehensions that this process of convergence may slow down for the 'late converger' countries like India.

- This is termed as the fear of "late converger stall".

- Challenges - The Survey notes that India needs to take on four challenges to ward off this fear.

- The four challenges in the process of economic development are:

- the backlash against globalization which reduces exporting opportunities

- the difficulties of structural transformation of transferring resources from low productivity to higher productivity sectors

- upgrading human capital to the demands of a technology-intensive workplace

- coping with climate change-induced agricultural stress

- Globalisation - Some 'early convergers' were able to post average export growth rates of over 15% for 30 years of their convergence periods.

- These include the countries like Japan, South Korea and China.

- However, a backlash in advanced countries against rapid globalization has led to a fall in world trade GDP ratios since 2011.

- This means a decline in exporting opportunities.

- Thus the advantage of favourable trading environment that early convergers had has begun to reverse.

- This could be a challenge for the late convergers like India.

- Structural Transformation - There is a difference in correlation between overall growth and 'good growth' between the early and late convergers.

- Dynamic sectors are those with high levels of productivity and potential for unconditional convergence.

- Good growth comprises growth accounted for by labour share shifts into these good sectors and their productivity growth.

- In this context, manufacturing is a critically important sector for ensuring a desired, successful transformation.

- However, “premature de-industrialization” is the scenario with manufacturing in many late convergers.

- The tendency for late convergers in manufacturing is to peak at lower levels of activity and earlier in the development process.

- This is a cause for concern.

- Because the shift is from informal, low productivity sectors to sectors that are only marginally less formal and only marginally more productive.

- This is a case of “thwarted structural transformation” which India needs to reckon with.

- Upgrading human capital - Late convergers like India have failed to provide even the basic education necessary for structural transformation.

- Evidently, in India, roughly 40 to 50% of rural children in grades 3 to 8 cannot meet the basic learning standards.

- Technology-intensive workplace will increasingly favour skilled human capital in the coming years.

- However, given the skilling shortfall, human capital frontier for the new structural transformation will shift further away.

- There is, however, some optimism that the trend has started to improve since 2014.

- Climate change - Growth rates of agricultural productivity for richer countries have been consistently greater than for developing countries.

- For India, agricultural productivity growth has been stagnant, averaging roughly 3% over the last 30 years.

- India is also vulnerable to temperature increase and still heavily dependent on rainfall.

- For late convergers, agricultural productivity is critical for feeding the population.

- But more importantly, it is essential in human resource aspect.

- This is given the transfer of human resource from agriculture to the modern sectors.

- Also, improving agricultural productivity is a key to achieving sustainable growth, given climate change and water scarcity.

- The Survey concludes that as of now India may not be faced with a “Late Converger Stall”, but need to act in time to ward it off.