How to control demand side Inflation?

Economy is working at full employment, aggregate supply meets aggregate demand [C+I+G+X-M], and general price level is established at 1 kg onions selling for Rs. 100/-

For some reason, if demand increases over supply, there will be a gap in this equilibrium, hence general prices will increase. This is (demand side) inflation. It happens when (one or more) components of the aggregate demand have increased. For example:

- Consumption (C) could have increased because junta is getting cheap loans. Rise of nuclear family with less ‘propensity to save’. Govt is giving tax-deduction incentives to those who buy new cars & computers. OR the best of all, under Deendayal Le-Lo Suitcase Yojana (DDLJ), BPL families are given 10-10 lakh rupees in DBT.

- Investment (I) could have increased because firms getting cheap loans or people enthusiastically buying their IPOs, shares, bonds, debentures and consequently, there is new demand for machines, factories, trucks and bulldozers.

- Government purchase (G) could have increased because of 7th Pay commission salary hike, new cars for ministers, more man-days given in MNREGA before general election & so on.

- Exports (X) could have increased- foreigners buying more of India’s tea, coffee and spices.

In all these scenarios, how can RBI control (demand-side) inflation?

- It can’t increase supply because economy is already working at full employment.

- It can’t prevent / reduce government expenditure.

- It can’t hike taxes to reduce juntaa’s shopping-spree.

- But, RBI can try to reduce the money supply / liquidity. Then loans will become expensive, there will be less consumption and investment. Then demand should shrink, and prices will come back to the equilibrium.

Why control deflation?

Economist William Philips gave a ‘curve’:

- मंहगाई बढ़ेगी तो रोजगार बढ़ेगा, महंगाई कम होगी तो बेरोजगार बढ़ेगा.

- When Inflation increases, employment will increase.

- When inflation falls, unemployment will increase: because consumers delaying purchases with the hopes that prices will fall even more. Firms laying off workers to keep the profit level same, or because they have unsold inventories, and hence don’t need extra workers to produce more, until the demand improves.

- Therefore, deflation is also not good for the economy.

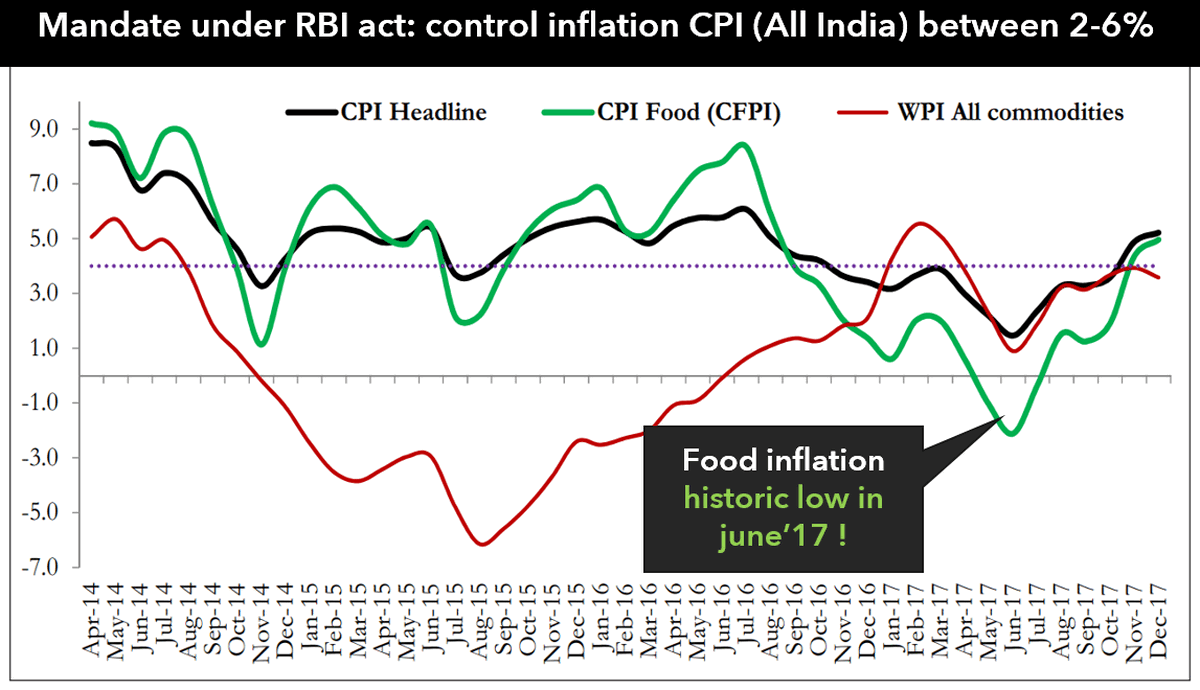

In other words, a stable and moderate level of inflation is good for the economy. RBI tries to maintain just that- keep the CPI (all India) inflation in the range of 2-6%.

From the discussion so far it should be clear that,

| How can RBI fight Deflation (fall in the prices)? | How can RBI fight Inflation (rise in the prices)? |

|---|

| Encourage consumption / investment by making loans cheaper. | Reduce consumption / investment by making the loans expensive. |

| For this, RBI should increase the money supply / liquidity | Decrease |

| Such policy is called easy / cheap / Dovish monetary policy. | Tight, Dear, Hawkish monetary Policy |

How to measure money supply?

So far we learn that, RBI can fight against inflation and deflation by controlling the money supply. But first RBI has to know how much money is there in the system? [तभी तो उसकी मात्रा को कम-ज्यादा कर सकते है.]

DD = demand deposit / मांग जमा (Current account, saving account); TD = time deposits / मियादी जमा (fixed deposits, recurring deposits etc.)

| Indicator | Component | +Bank’s DD | +Bank’s TD | +Postoffice DD | +Postoffice TD |

|---|

| M0 (Reserve Money, high powered money:आरक्षित निधि) | Total currency in circulation | NA | NA | NA | NA |

| M1 (narrow money: संकीर्ण मुद्रा) | Currency with junta | YES | NO | NO | NO |

| M2 | Currency with junta | Yes | NO | YES | NO |

| M3 (broad money / aggregate money: विस्तृत मुद्रा) | Currency with junta | YES | YES | NO | NO |

| M4 | Currency with junta | YES | YES | YES | YES |

- In terms of liquidity: M1 > M2 > M3 > M4 (because time deposits are less liquid than demand deposits)

- In terms of size / quantity: M1 < M2 < M3 < M4 (because M4 will have maximum maal of all types of bank & post-office deposits combined)

- Economic Survey vol2 Ch3 gives lengthy ball by ball commentary on the growth and fall of M1 and M3 before and after demontization but such PHD has little cost:benefit for MCQs.

(MCQ) Difference between M3-M1 will provide us which figure?

- Public’s Time deposits held in banks and post office

- Public’s Demand deposits held in banks and post office

- Public’s Time deposits held in banks

- Public’s Demand deposits held in banks

h/ from the table above, it should be clear that M1+ Banks’ time deposits = M3. Therefore, M3-M1= Banks’ time deposits.

Quantitative Tools of Monetary Policy

| Quantitative Tool | Function | How to use against deflation | How to use against inflation? |

|---|

| CRR: Cash Reserve Ratio (4%)नकदी आरिक्षत निधि अनुपात |

- From their net demand and time liabilities (NDTL), banks have to keep aside that much cash as reserve.

- They can’t loan it, invest it, buy gold or government securities from it.

- Self-study related topic: Incremental CRR after demonetization.

| Reduce it |

- Hike it, so banks have less loanable funds, they’ll be forced to raise lending rates to keep same profit margin, thereby decreasing aggregate demand’s Consumption and investment (C+I)

- Associated topic is “Money Multiplier effect”, learn it from my lecture.

|

| SLR (19.5%)Statutory liquidity ratio

सांविधिक नकदी अनुपात

|

- From their net demand and time liabilities (NDTL), Banks have to keep that much money in liquid assets such as cash, gold, Government securities (G-Sec) and other securities approved by RBI

| Same as above | Same as above |

| LCR: HQLA |

- LCR-HQLA’s objective is to safeguard against “bank runs” (i.e. too many people simultenously rushing to withdraw deposits)

- LCR-HQLA is and not meant for combating inflation. Still, if we had to use then, principles will be same like SLR.

- For details of LCR-HQLA, scroll down to read the article further.

| Same as above | Same as above |

| Bank rate |

- When banks want to borrow long term loans from RBI without pledging any securities or collaterals, this is the interest rate they have pay.

- Penalties rates for non-maintenance of CRR and SLR are linked with Bank Rate.

- From 2012, Bank Rate = MSF.

| Decrease so banks borrow cheaply and loan out cheaply, thereby increasing C+I | Increase |

| MSFMarginal Standing Facility

सीमांत स्थायी सुविधा

|

- When scheduled commercial banks want to borrow short-term funds from RBI by pledging their SLR-quota securities, this is the interest rate they have to pay.

- MSF is linked with Repo rate. Presently MSF = repo + 25 basis points.

| Decrease | Increase |

| LAF-RepoLiquidity Adjustment Facility:

तरलता समायोजन सुविधा- रेपो दर

|

- When any client of RBI (Union government, state government, banks, nonbanks) wants to borrow short-term funds from RBI by pledging G-securities, this is the interest rate they have to pay.

- Repo rate is also called the policy rate or benchmark interest rate of India.

| Decrease | Increase, so bank borrow less from RBI and lend less. and in case of govenrment clients, they’ll spend less (G components of demand). |

| LAF-Reverse Repo rateउत्क्रम-रेपो दर. |

- Clients earn this much interest when parking their money in RBI for short term. RBI pledges G-Secs as collaterals. (जी-सिक्यु जमानत के रूप में दी जाएगी)

| Decrease | Increase. So, RBI’s clients feel more attracted to park their money in RBI rather than circulating it as loans. |

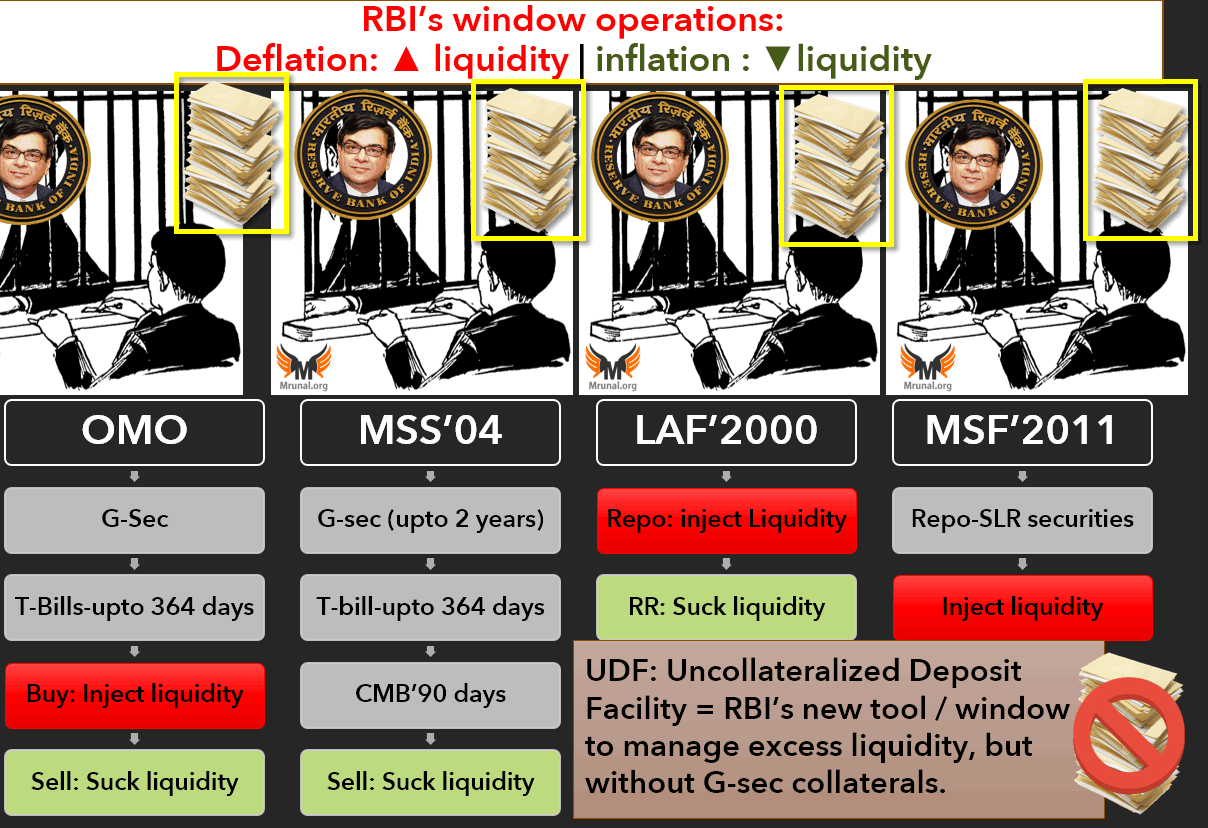

UDF: Uncollateralized Deposit Facility

असंपार्श्विक / गैर जमानती जमा सुविधा |

- Similar to above but RBI will not pledge any G-sec as collateral. (जमानत के स्वरूप में कुछ भी नही देंगे)

- This was proposed in Budget-2018. For more details scroll down.

| The objective of UDF is to help RBI suck excess liquidity. so, not applicable in this scenario. | same as above. |

| Open Market Operation खुले बजार में खरीद-व्-बिक्री |

- RBI buys or sells government securities / treasury bills in the open market in order to increase or decrease money supply / liquidity.

| Buy : inject liquidity : cheap loans | Sell G-sec to suck liquidity, thereby making the loans expensive. |

| MSS: Market Stabilisation Schemeबाजार स्थिरीकरण योजना |

- RBI sells G-sec, T-bill and cash management bills (CMB) to suck excess liquidity.

| N/A | Same as above. MSS purchase using CMB had to be done at grand-scale after demonetization, otherwise banks were flush with deposits, they might have brought down loan interest rates to 2-3%, but then juntaa will also get less deposit interest rate, which could hurt senior citizens. लों ब्याज दरे एकदम सस्ती हो जाए वो भी बेंक के बचत-ग्राहकों के लिए उपयुक्त नही.. |

New Quantitative tools

UDF / SDF

- So far we learned that to absorb excess liquidity using MSS or OMO-purchase or reserve report rate, RBI will need G-sec as collateral.

- But during the demonetization, RBI faced a problem: there was excessive liquidity (in the bank deposits) but not enough G-sec to absorb it. If such excessive liquidity not removed, then lending rates will fall, people will borrow for speculative investment in gold, real-estate and sharemarket, and worst of all, if lending rates fall then deposit rates will also fall (i.e. the interest earned on savings account, fixed deposits etc) – this will hurt senior citizens. इसलिए बहुत ज्यादा तरलता व् बहुत सस्ते ब्याज दर नुक्सानकारी है.

- Central banks in the advanced economies have solution to this. They can simply promise to pay (interest) without any ‘G-sec’ as guarantee / collateral to the other party. Then commercial banks will park money in Central bank, excess liquidity gone, loan interest rates increase and inflation is averted. Such system is called Standing deposit facility (SDF) / Uncollateralized Deposit Facility (UDF).

- Term SDF was used by Urjit Patel in the monetary policy of 2017-April.

- Term UDF was used in Budget-2018.

- Budget 2018 proposed Uncollateralized Deposit Facility for RBI, to absorb excess liquidity. Government will amend RBI act for this.

(Mock MCQ) Budget-2018 proposed an uncollateralized deposit facility with the objective of :

- Providing easier loans to farmers

- Providing easier loans to MSME without any collateral

- Help NABARD to refinance agriculture loans from world bank.

- Provide RBI with a new tool to manage excess liquidity.

h/ No need to do PHD over SDF / UDF from internet- like what will be its maturity period, how it affects the bond yields and exchange rates. If at all such technical term from monetary policy is asked, UPSC will keep other three options blatantly wrong so they can be eliminated easily- AND not because UPSC examiner is in good mood after watching Comedy Nights with Kapil, but because he has to ensure that candidates from poor families without time / money to spend 24/7 on internet research – also have chance to clear prelims.

Central Bank Liquidity

Nothing important, but term given in Eco Survey 2016-17’s volume-II. So we should learn:

At any point of time,

- Some banks borrow money from RBI’s repo window, say Rs.60

- Some banks park their money in RBI’s reverse repo window, say Rs. 40

So, NET 60 MINUS 40 = +20. It means central bank (RBI) injected liquidity in the system. If answer was a negative figure, then It’s said that RBI absorbed liquidity from the system.

Liquidity Coverage Ratio (LCR) & HQLA

BASEL-III norms mandated that banks have to keep enough amount in high quality liquid assets (HQLA) so that bank can survive a 30 days stress-test scenario. HQLA eligible assets includes:

- Cash, including foreign currency.

- Cash beyond CRR

- G-Sec beyond SLR

- Marketable securities backed by PSE, Multilateral development banks, Foreign Governments.

Within above, there is internal classification: Level1, 2A, 2B type HQLA assets. But that’s useless for UPSC prelims. What you’ve to mugup is:

- If bank has sufficient HQLA to survive total net cash outflow for next 30 calendar days, we’ll say its liquidity coverage ratio is 1 (or 100%).

- To help Indian banks comply with this provision, RBI began implementing LCR in gradual manner since 2015 (60%, 70% .. like that it was raised every year).

- From 1/1/2019, banks have to keep an LCR of 100% or MORE.

- If SLR is kept high and LCR is also implemented, then Indians banks will have less loanable funds (नंगा नहायेगा क्या और निचोडेगा क्या?) therefore, in recent times RBI has gradually reduced SLR while hiking the LCR requirement, (ताकि दोनों तरफ से बेंको को मार न पड़े.)

(Mock MCQ) In 2016-17, RBI has been gradually reducing SLR, to help the Banks in which area?

- To help banks in currency shortage post-demonetization.

- To help banks come out of the NPA and Twin Balance sheet problems.

- To increase banks’ loanable funds for PSL

- To help banks meet with liquidity coverage ratio (LCR) norms.

h/ Only word-association has to be done. As explained earlier, IF AT ALL UPSC asks MCQ from such technical terms, it’ll be testing your basic knowledge only.

Monetary Policy Committee (मौद्रिक निति समिति)

Any central bank has three ways to design a monetary policy

| Governor should focus on | Who follows this strategy? |

|---|

| 1) Exchange rate stability | Singapore & other export oriented economies. |

| 2) Multiple Indicators such as Growth, Employment, Inflation WPI,CPI, Exchange rate stability. | India till 2016-October. |

| 3) Inflation targeting |

- This model is successful in western nations. Instead of trying to focus on multiple indicators like GDP and employment, simply focus on control inflation.

- For this, usually Repo rate is kept at higher rate than CPI, then other things will fall in line automatically.

- (the then Dy.Governor) Urjit Patel Committee recomended this to Governor Rajan.

- To implement this method, RBI Act was amended in 2016 (August) with following provisions:

|

- Government will decide the inflation target with consultation of RBI.

- For 2016-2020, the inflation target is CPI (All India) 4% with spread of +/-2% (in other words keep inflation within 2-6%)

- This target will be achieved by a statutory monetary policy Committee under the RBI Act.

Composition of RBI’s Monetary Policy Committee

| RBI side | Government side: nominated for four years, no reappointment |

|---|

| 1) Dr. Urjit R. Patel: Ex-officio chairman because he’s the RBI Governor. | 4) Dr. Chetan Ghate: from Indian statistical institute |

| 2) Dr. Viral V. Acharya. Dy. Governor incharge of monetary policy dept | 5) Dr. Pami Dua: Delhi school of economics |

| 3) Dr. Michael Debabrata Patra. Executive director of RBI | 6) Dr. Ravindra H. Dholakia: HoD of IIM-A’s Economics dept |

- If Committee fails to keep inflation within this range for three consecutive quarters (= 9 months) then they’ve to publish a report on why they failed, and how they’ll rectify it?

- Committee will meet every two months to decide the RBI’s policy rate (= repo rate)

- Committee’s decision will be binding on RBI.

- Decision will be taken by majority vote. If there is a tie, then RBI Governor will have the casting vote.

- By 14th day of the meeting, its minutes have to be published.

- Government can send its messages to the Committee only in writing (this provision to ensure that no undue pressure is put on the members e.g. चुनाव आ रहे है तो आप ब्याज दर घटाकर 0% कर दो!)

(Prelim-2017) Correct regarding the Monetary Policy Committee (MPC)?

- It decides the RBI’s benchmark interest rates.

- It is a 12-member body including the Governor of RBI and is reconstituted every year.

- It functions under the chairmanship of the Union Finance Minister.

Answer Codes:

- 1 only

- 1 and 2 only

- 3 only

- 2 and 3 only

h/ If i’ve to give hint for this MCQ also, then you should go to bookmyshow dot com and book a movie ticket for 3rd June 2018.

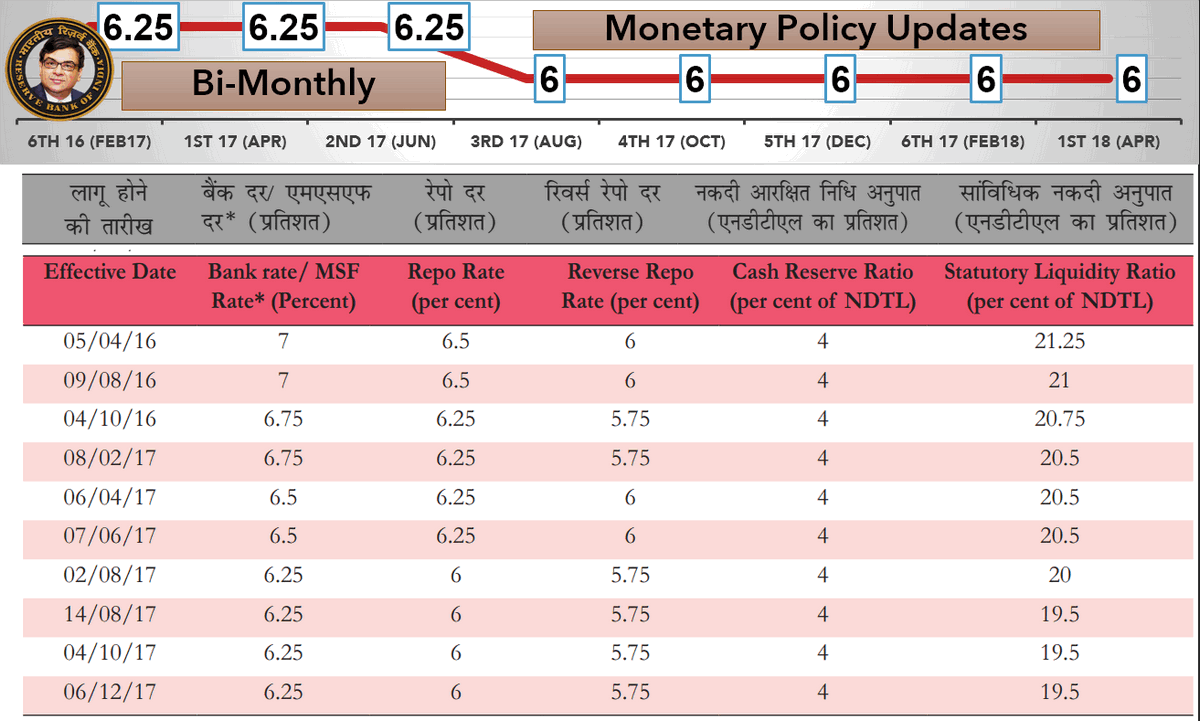

Bi-Monthly Monetary policy updates FY: 2017-18

2017-April

I’ve covered this in

my last year’s lecture. Repo rate was unchanged @6.25%. Let’s look at the policy updates after that:

2017-JUNE

| Facts presented before the Committee: | What to with policy rate (repo rate) |

|---|

| 1st April 2017: Bharat Stage-IV emission norms came into force. Sale of vehicles down because these new model vehicles are more expensive. |

- If auto-industry starts cutting workforce, the aggregate demand could fall, leading to deflation.

- So, RBI should reduce repo to boost vehicle loans. Although this is negative for environment but RBI’s mandate is not environment protection.

|

- May-2017: Record AGRO output.

- JUNE-2017: IMD confirms normal and well-distributed south-west (June-September) monsoon.

| Wait and watch. Because inflation / deflation in the food-market is not solely dependent on record food-inflation. |

| State governments announcing farm loan waiver -> higher fiscal deficit -> inflation. | Hike repo to avert inflation |

| Under GST regime, businessmens’ working capital requirement has increased because 1) whatever tax they collected from junta, it has to be deposited by 20th of the next month. 2) issues related to claiming credit / refunds of the exported goods and services. | Reduce repo rate so businessmen get cheap working capital. |

| PM Awas Yojana (urban) can perform better IF builders and lower middle class get cheap loans. | Reduce repo rate |

| Final Decision | Repo rate unchanged @6.25% |

2017-AUGUST

| Facts presented before the Committee: | What to with policy rate (repo rate) |

|---|

| CPI (Food inflation) was historic low, it went into negative territory. | While this is a happy news for the middle-class housewives, but RBI has to control inflation between 2-6%, that means even deflation has to be fought off. Therefore, repo rate should be cut. Cheaper loans (to kissan ketchup, real fruitjuice) = more demand than supply = food prices should revert back. |

| Normal monsoon predicted. Food processing companies will benefit if cheap working capital available. | Reduce repo rate |

| Recovery in the advance economies (AE). Global exports improved. | Reduce repo rate so exporters can benefit. |

| Since 1st April 2017, BS-IV emission norms vehicles became compulsory. Since they’re more expensive, there is fall in vehicle-sales. | Reduce repo rate so people get cheap bike loans and car loans, so that auto-industry can benefit. |

| Outcome? |

- Repo rate reduce by 25 basis point. (0.25%)

- New repo rate: 6.25 minus 0.25 = 6%

- Policy corridor was narrowed to 25 basis point. Meaning

- Repo + 0.25 = MSF

- Repo – 0.25 = Reverse Repo

|

Other developments?

Other developments?

- RBI issued guidelines for Tri-Party repo agreement. (explained in same lecture in which I covered 2017-April policy)

- RBI sets up a task force on “Public credit registry”. (more in NPA article)

2017-October

| Facts presented before the Committee: | What to with policy rate (repo rate) |

|---|

- Vegetable prices increasing

- Government has asked state oil companies to keep raising prices of subsidized kerosene by 25 paise every fortnight until the kerosene subsidy is eliminated.

- International crude oil and LPG prices also rising.

| ये तो बहुत चिंता का विषय है!! afterall, RBI is given sacred target to control inflation below 6% of CPI. So, better we hike the repo rate! |

| Commercial banks have not fully passed-on previous rate cut i.e. they’re yet to cheapen their lending rates. | then better wait and watch. |

| Final Decision | Repo rate unchanged @6% |

Other developments?

- RBI issued guidelines for Peer to Peer (P2P) Lending. (will study under NBFC article)

- RBI allowed non-scheduled cooperative banks to open accounts with RBI so they don’t have to park their CRR in other scheduled banks. (not-relevant for UPSC)

- RBI ordered banks to give special attention to Senior citizens and PH.(not-relevant for UPSC)

2017-December

| Facts presented before the Committee: | What to with policy rate (repo rate) |

| CPI inflation is on rise again. | Increase / Hike Repo rate |

| November 2017: GST council reduced GST from 28% to 18% on ~170 items (perhaps to appease the voters before Gujarat assembly election of December 2017). |

- By default, cheaper tax should boost consumption -> inflation -> hike repo rate to thwart it.

- But better we wait and watch until it is actually reflected in the MRP. Because industries usually hike their ‘base price’ to profit more, instead of passing the benefit of lesser GST to the customers. e.g. chocolates

- BEFORE: Rs.100 (base price) + 28% GST = 128/-

- AFTER: Rs. 108 (base price) + 18% GST = Rs. 128/-

|

| New IPOs issued in primary market. The entrepreneurs will boost construction and jobs from such share-capital. |

- Aggregate demand’s “investment (I)” component will rise. By theory, we should hike repo rate to thwart the inflation.

- But better we wait and watch, until CPI crossed the danger zone (>6%)

|

| WTO data says that while advanced economies (AE) recovering, global trade & export are declining due to their protectionism. | Cut the repo rate. Cheap interest rate should boost local consumption. |

| Final Decision | WAIT & WATCH कोरबे चालो. यानि की Repo rate unchanged 6%. |

Other developments?

- RBI tweaked MDR rules. (already covered in last article)

- RBI tweaked norms for refinancing of ECB loans by overseas Indian banks, commodity hedging by residents etc (not-relevant for UPSC)

2018-FEBRUARY

Technically, this is the sixth and last bi-monthly monetary policy of the financial year 2017 – 18.

| Facts presented before the Committee: | What to with policy rate (repo rate) |

| Economic Survey data says: Growth rate fell from 8% in 2015 to 6.5% in 2017. | ये तो बहुत चिंता का विषय है! Reduce repo rate to boost consumption and thereby production in our economy. |

- Budget documents show that the absolute figures the fiscal deficit is rising from 5.95 lakh crores (2017) to 6.24 crores in Budget-2018.

- Economic survey also feared that deficit may rise even further before the general election of 2019 (if government announces populist schemes to appease the voters).

|

- Fiscal deficit leads to inflation. Therefore, better we increase repo rate to prevent inflation.

- Counter: Fiscal deficit led to inflation in the earlier times because of the subsidies leakage –money going into the hands of corrupt people who spend lavishly, thereby raising aggregate demand compared to the supply.

- But, now, Aadhar-enabled authentications, and direct benefit transfer so less chances of susbidy leakage and the associated inflation.

- another-view: Higher fiscal deficit = higher borrowing by the government = crowding out of the corporate borrowers from the credit market. (because corporates will have to offer more interest to the investors). So, better we reduce the repo rate to help industrialists.

|

| Budget-2018 is pro-poor, pro-rural. |

- More money in the hands of poor people (working in MNREGA or receiving some Government subsidy) => more consumption => inflation, we should increase repo rate to prevent it.

|

- Budget-2018 announced MSP = 1.5 x input cost. Farmers will receive more money and they’ll consume more (C)

- Foodgrain-Merchants will be forced to offer more price to the farmers (because If farmer sells everything to FCI only, then private grain-seller will have to shut his shop!) But then merchant will increase the retail price of food-grains to keep his margin safe.

|

- Prima-facie it appears that “1.5XMSP” will bring inflation in the food-grains and therefore, we should hike / increase repo rate to prevent inflation.

- But, government yet to announce how exactly this 1.5XMSP will be implemented.

- Until then, better wait and watch.

|

- Budget-2018 increased custom duty on many items to make them expensive, and thereby encourage people to buy swadeshi items produced under the “Make in India”.

| We should reduce the repo rate to help local entrepreneurs and customers |

- Advanced economies are recovering, they’re importing more crude oil and commodities.

- OPEC cartel & Russia have already been cutting their oil-production to drive up the crude-oil prices.

| This will bring inflation in India. We should hike repo rate to prevent inflation. |

- As the advanced economies are recovering, foreign investors are pulling money out of Indian market.

|

- This will weaken Indian rupee, and thereby increase inflation (because imported crude oil gets more expensive).

- It’s true that petrol-diesel don’t have very high weightage in computation of CPI, but with expensive fuel, the transport-services will get expensive, therefore CPI could rise > 6% inflation target.

- We should hike repo rate to prevent inflation.

|

| Final Decision? |

- WAIT & WATCH कोरबे चालो. यानि की Repo rate unchanged @6%.

- By now it should be clear to you that real policy making is not straightforward like textbook-theory or strategy-video-game.

|

Other developments?

- RBI announced Ombudsmans for NBFCs. (more in the NBFC article)

- RBI observed that even though it had reduced repo rate in the past, the banks have not sufficiently reduced their loan-interest rates, because many of the loans were given under the erstwhile BASE-RATE system. (which was less efficient in transmission of monetary policy compared to the MCLR system of computing loan-interest rates). Therefore, RBI made certain technical rules for linking the base-rate loans with MCLR.

- Previously, RBI was providing subsidy to the banks for installation of ATM-Cash recycler machine. But as sufficient number of machines have been installed, RBI stopped the scheme.

- RBI tweaked certain technical rules about priority sector lending norms (sub-quota MSME service sector industries), but that is not important for UPSC.

- Next meeting on 4-5th April 2018.

2018-April

Technically, this is the first bimonthly monetary policy of the financial year 2018 – 19.

| Facts presented before the Committee: | What to with policy rate (repo rate) |

| Same bolbachchan continues. Crude oil price hike. | Hike repo rate to fight inflation |

| Rice, pulse, coarse cereals – record production. But, Wheat production is lower than last year because of 1) low soil moisture 2) lower area under cultivate. But wheat-imports will suffice in worst case. | Wait and watch. |

| GST had a transitional adverse effect on urban consumption. There is loss of output and employment in the labor-intensive unorganized sector. | Reduce repo rate to boost consumption. |

| Private consumption is improving: in terms of number of air ticket sales, foreign tourist arrivals, sale of bikes & tractors. | Wait and watch. |

| 7th Pay commission: higher house rent allowance (HRA) raised Government Expenditure (G) and the ‘consumption’ (C). This will generate inflationary impact till middle of FY2018-19. | Increase repo rate to fight inflation |

| “Fiscal slippage” for FY2017-18 i.e. Government crossed the fiscal-deficit target. | More Fiscal deficit => inflation. So, Hike repo rate to fight inflation |

| Global economy recovering: if we look at ship container freight, air freight and export orders. But, intensification of a “trade war“ between USA and EU. | Wait and watch. |

| Both crude oil and gold prices are rising. |

- Hike repo rate to fight inflation.

- It’s not RBI’s DPSP-mandate to keep ‘gold affordable’, but as gold prices begin to rise, some investors begin speculative investment in gold- that leads to more Current account deficit -> weaker rupee. And weaker rupee = expensive crude oil= is mother of inflation.

|

| Final Decision? |

- WAIT & WATCH कोरबे चालो. यानि की Repo rate unchanged @6%.

|

Other developments?

In the first monetary policy of any new financial year, RBI will announce more measures compared to other months. Same happend in April-2018:

- RBI deferred implementation of IndiAS accounting system for Indian commercial banks till 1/4/19. (more on this in the SEBI Kotak Panel article).

- BASEL-III counter cyclic capital buffer (CCCB) not required to be maintained. If the central bank feels that after four quarters there will be economic slowdown, then they’ve to notify CCCB in advance. More under BASEL article.

- Derivative markets’ non-person entities need to obtain Legal Entity Identifier (LEI). More under NPA article.

- Payment System data must be stored in India within next 6 months. Already covered in last article.

- No entity regulated by RBI shall deal with Virtual-currency / cryptocurrency. Ye bhi covered in last article.

- RBI’s inter-departmental group formed to check desirability and feasibility to introduce a central bank digital currency. Report by end-June 2018. Ye bhi covered in last article.

- RBI data science lab for various big-data analytics on inflation, currency, debt, financial market intelligence etc. by Dec.2018

- Post-2006: Cash-in-Transit (CIT) companies and Cash Replenishment Agencies (CRAs) doing the cash-management work for the banks on outsourcing basis. But no separate law to regulate them. Hence, RBI will encourage these entities to setup their own self-regulatory organization. [similar to News Broadcasters Association (NBA) for TV-news channels.]

- For financial literacy, five new customized booklets will be created for Farmers, Small entrepreneurs, School children, Self Help Groups and Senior Citizens.

- 1969: Lead bank scheme was introduced. For each district, one bank will be designated as lead bank, and it’ll have to make efforts for financial inclusion. This scheme will be reviewed/ optimized.

Next Monetary Policy?

| 05-Apr-18 | First Policy. Upto this, we’ve covered in this article. |

| 06-Jun-18 | Second Policy. But Prelim on 3rd June |

| 01-Aug-18 | Third Bi-monthly Monetary Policy of 2018-19 |

| 04-Oct-18 | Fourth Bi-monthly Monetary Policy of 2018-19 |

| 05-Dec-18 | Fifth Bi-monthly Monetary Policy of 2018-19 |

| 06-Feb-19 | Sixth Bi-monthly Monetary Policy Statement for 2018-19 |

(Mock MCQ) Find incorrect statements about the monetary policy in India:

- Policy rate has been reduce only once during FY2017-18.

- RBI has reviews the monetary policy on monthly basis.

- All decisions of RBI’s monetary policy committee have been taken unanimously during 2017-18

Answer Codes:

- Only 1 and 2

- Only 2 and 3

- Only 1 and 3

- All of them

h/ RBI Monetary Policy Committee has six members to review the policy every two months. Decisions are to be taken by majority vote. If we look at the meeting minutes for FY18, usually Dr. Ravindra Dholakia (IIM-A) would want to reduce the repo rate to boost demand and employment, Whereas Michael Patra (RBI Executive Director) would want to hike to repo rate to combat inflation.

Q. Which of the following scenario merits a cut in the monetary policy rate?

- Fall in the stock exchange indexes.

- Announcement of farm-loan waiver by the Government

- Plummeting of IIP, CPI, export and GDP growth rate figures.

- None of the above.

h/ If IIP, CPI, GDP and exports are down, does it not show a trend towards deflation?

Limitations of Monetary Policy in combating inflation

- Monetary policy can’t control supply side issues, Fiscal deficit, leakage of Government money to informal money lenders- and their impact on the loan market.

- Repo borrowing is not major source of funding for Indian banks. So, changing repo will not immediately impact the bank loan rates.

- Even if RBI cuts repo rate, banks are not cutting lending rates due to NPA problem.

- These issues are discussed in depth, in my last year’s lecture video.