What is the issue?

The two biggest economies USA and china are engaged in a tariff war, which would disrupt world trade.

What are recent moves of USA and China led trade wars ?

- Tariffs, or customs duties, are border taxes charged on foreign imports by a country.

- Recently US government slapped sweeping tariffs on imported Chinese goods worth $34 billion, including aircraft parts, flat-screen televisions, and medical devices.

- All these will now face a high 25% levy when imported into the US.

- China responded with retaliatory tariffs of 25% on US goods worth an equivalent $34 billion, including soybean, automobiles, and marine products such as lobsters.

- USA is also considering to impose levies on Chinese goods worth another $500 billion in the coming months.

What are the reasons behind such moves?

- USA’s Point - USA’s tariffs are aimed at penalising China for arm-twisting foreign businesses to hand over technology to Chinese firms in lieu of access to the Chinese market.

- The US has indicated this action is specifically aimed at protectionist measures by China, especially its “Made in China 2025” programme, an initiative to transform China into an advanced manufacturing powerhouse.

- USA has also accused China of subsidising steel exports in a practice termed dumping selling a product at lower than the cost of production to gain market share.

- China’s Point - Besides slapping retaliatory tariffs on US goods, the Chinese could leverage an anti-American sentiment among consumers to boycott US goods.

- In 2012, Chinese nationalists boycotted Japanese cars and stores because of a territorial dispute, badly denting sales of Japanese goods.

What will be the consequences of the trade war?

- Last year, China had imported $130 billion in US goods, while the US bought goods worth $506 billion from China, So, the goods trade is weighed in favour of China.

- US economy could actually suffer more than China’s, and that South Korea, Malaysia, Taiwan and Singapore are the economies most at risk in Asia based on trade openness and exposure to supply chains involving China.

- After the latest series of tariff strikes by the US and China, world trade could be seriously disrupted as two-thirds of goods traded are linked to global value chains.

- There are also projections that almost two-thirds of US imports from China came in from companies with foreign capital and, based on foreign investment flows, the capital is likely to have come mostly from the US, Japan and South Korea.

What measures would be taken by China?

- Chinese government has indicated earlier that it would appeal to the World Trade Organization’s Dispute Settlement Body.

- If the appeal is admitted, trade analysts predict that China could have the upper hand, given the record of plaintiffs almost always ending up on the winning side.

- The retaliatory tariffs by China could potentially spark dissent and pressure from US domestic lobbies.

What are the concerns before India?

- India’s total exports have been faltering, down from $310.53 billion in FY15 to $262.29 billion in FY16, before recovering marginally to $276.55 billion in FY17.

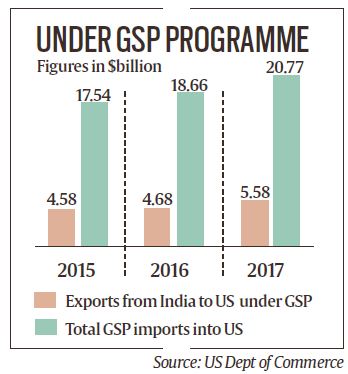

- Exports from India to the US under Generalized System of Preferences (GSP) have been consistently on the rise, bucking the broader declining trend in overall exports.

- Generalized System of Preferences (GSP) is a preferential tariff system extended by developed countries to developing countries.

- Out of the total GSP imports into the US under this programme, India has consistently accounted for a quarter of this.

- USA’s pointed attack on duty flow imports from India into the US has specifically targeted the GSP programme.

- India has time and again raised concerns over negative impact of tightening of visa norms by the US on the Indian IT sector.

- It has also asked America to continue extending duty-free access under the Generalized System of Preferences (GSP) to its products such as chemicals and engineering.

- India also wants exemption from the hike in import duty on certain steel and aluminium items.